Fort Nelson Indian Reserve Minerals Revenue Sharing Act (S.C. 1980-81-82-83, c. 38)

Full Document:

- HTMLFull Document: Fort Nelson Indian Reserve Minerals Revenue Sharing Act (Accessibility Buttons available) |

- XMLFull Document: Fort Nelson Indian Reserve Minerals Revenue Sharing Act [104 KB] |

- PDFFull Document: Fort Nelson Indian Reserve Minerals Revenue Sharing Act [807 KB]

Act current to 2024-06-19

SCHEDULE

THIS AGREEMENT is made as of the 1st day of January A.D. 1977, BETWEEN:

Her Majesty the Queen in Right of Canada represented herein by the Minister of Indian Affairs and Northern Development

(hereinafter called “Canada”)

OF THE FIRST PART

AND

Her Majesty the Queen in Right of the Province of British Columbia, represented herein by the Attorney-General and the Minister of Energy, Mines and Petroleum Resources

(hereinafter called the “Province”)

OF THE SECOND PART

WHEREAS:

A By Treaty No. 8, the Fort Nelson Indian Band (hereinafter called the “Band”) for various considerations surrendered to Canada all their rights, titles and privileges whatsoever to certain lands within British Columbia, such considerations including the setting apart of lands to be reserved for the exclusive use of the Band;

B By British Columbia Order-in-Council No. 2995 dated the 28th day of November, 1961, certain lands were conveyed by the Province to Canada in trust for the use and benefit of the Fort Nelson Indian Band purporting to be in accordance with Interim Report No. 91 of the Royal Commission on Indian Affairs in British Columbia, established pursuant to an agreement dated the 24th day of September, 1912, between J. A. J. McKenna, Special Commissioner appointed by Canada, and the Honourable Sir Richard McBride as Premier of the Province of British Columbia;

C The Province, by the said Order-in-Council No. 2995, reserved unto itself all rights to any minerals, precious or base, including coal, petroleum and any gas or gases underlying the Reserve and the Band, through Canada, took exception to this said reservation as being contrary to the terms and meaning of, inter alia, the aforesaid McKenna-McBride agreement and Treaty No. 8;

D The Band, through Canada, has continued to demand from the Province conveyance to Canada as Trustee for the Band of the rights to any minerals, precious or base, including coal, petroleum and any gas or gases underlying the Reserve;

E It has been agreed between Canada, in its own right and on behalf of the Band, and the Province to resolve this long-standing issue of rights to any minerals, precious or base, including coal, petroleum and any gas or gases underlying the Reserve by the parties entering into this Agreement to provide, inter alia for ownership, administration and control by the Province of coal, petroleum and any gas or gases underlying the Reserve, and for equal sharing between Canada and the Province of the net profit and gross revenue from the disposition of coal, petroleum and any gas or gases, and such other minerals as are herein defined, underlying the Reserve;

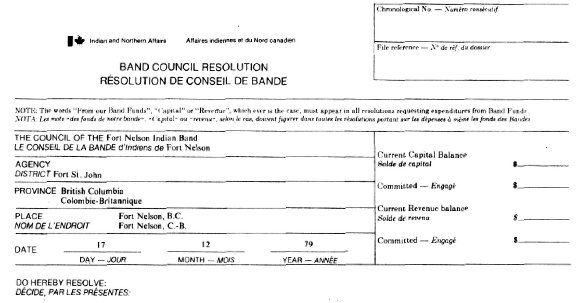

F The Band Council has by Band Council Resolution dated the 17th day of December 1979, a copy of which is attached hereto as Schedule “A”, approved this Agreement, and has requested that the Minister of Indian Affairs and Northern Development order that a referendum be held for the purpose of obtaining from the Band a surrender and approval to enter into this Agreement;

G Canada is required to obtain from the Band pursuant to, and in accordance with the provisions of the Indian Act, R.S.C., 1970, Chapter I-6, a surrender and approval to enter into this Agreement in the form attached hereto as Schedule “B”.

NOW THIS AGREEMENT WITNESSETH that in consideration of the premises Canada and the Province mutually COVENANT AND AGREE as follows:

1 DEFINITIONS

In this Agreement:

(1) Basic Agreement means the agreement, dated November 13, 1973, between the British Columbia Petroleum Corporation (hereinafter called the “Petroleum Corporation”) and Westcoast Transmission Company Limited (hereinafter called “Westcoast”);

(2) Clarke Lake Field means the natural gas pool commonly known as Clarke Lake Field Slave Point Pool A, being the natural gas pool lying within the lands described in Schedule “C”;

(3) Domestic Utilities means the corporations named in Clauses (a), (b), (c), (d) and (e) of sub-paragraph (6) hereof and the successors to or assigns of the rights to purchase Natural Gas from Westcoast under the contracts referred to in the said Clauses (a), (b), (c), (d) and (e) and Domestic Utility means any one thereof;

(4) Excepted Minerals means all minerals, precious or base including coal, petroleum and any gas or gases which may be found in, upon or under the lands conveyed by the Province to Canada in trust for the use and benefit of the Band by British Columbia Order-in-Council No. 2995 dated the 28th day of November, 1961;

(5) Foreign Utility means Northwest Pipeline Corporation, its successors to, or assigns of, the right to purchase Natural Gas pursuant to the contract referred to in paragraph 1(6)(f) hereof;

(6) Gas Sales Contracts means those contracts under which Westcoast sells Natural Gas, specifically the contracts it has with:

(a) B.C. Hydro Power Authority dated October 29, 1967

(b) Inland Natural Gas Co. Ltd. dated November 1, 1968

(c) Pacific Northern Gas Ltd. dated December 16, 1969

(d) Peace River Transmission Co. Limited dated October 31, 1967

(e) Plains-Western Gas & Electric Co. Limited dated July 1, 1974

(f) Northwest Pipeline Corporation dated October 10, 1969;

(7) Judge means a Puisne Judge of the Supreme Court of British Columbia;

(8) Mcf means the volume of Natural Gas which occupies one thousand cubic feet when at a temperature of 60° Fahrenheit and (unless otherwise stated) at a pressure of 14.65 pounds per square inch absolute;

(9) Natural Gas means all fluid hydrocarbons, both before and after processing, which are not defined as petroleum and includes hydrogen sulphide, carbon dioxide and helium contained in fluid hydrocarbons;

(10) Net Residue Gas Supply means that portion of Residue Gas Supply which is attributable to Natural Gas produced in the Province of British Columbia;

(11) New Gas means Natural Gas which is produced in the Province of British Columbia and which is obtained through a well:

(a) which draws from a pool, no part of which flowed prior to November 14, 1973, or

(b) the spacing area of which lay as of the date of the spudding of such well wholly outside the outline (as described from time to time by the Chief of Branch under the Petroleum and Natural Gas Act, S.B.C. 1965, c. 33) of each Pool drawn upon by such well;

(12) Old Gas means Natural Gas which is produced in British Columbia but does not come within the classification of New Gas;

(13) Person includes a corporation;

(14) Petroleum means crude petroleum and all other hydrocarbons, regardless of gravity, that are or can be recovered in liquid form from a Pool through a well by ordinary production methods or that are or can be recovered from oil sand or oil shale;

(15) Pool means an underground reservoir containing an accumulation of Petroleum or Natural Gas or both, separated or appearing to be separated from any other such reservoir or accumulation, and characterized by a single pressure system such that production of Petroleum or Natural Gas from one part thereof affects the reservoir pressure throughout its extent;

(16) Production Month means a period of time beginning at eight A.M. (P.S.T.) on the first day of the calendar month and ending at eight A.M. (P.S.T.) on the first day of the next succeeding calendar month;

(17) Reserve means the lands conveyed by the Province to Canada by British Columbia Order-in-Council No. 2995 of 28th November, 1961 and which are presently set aside by Canada for the use and benefit of the Band as reserves within the meaning of the Indian Act R.S.C., 1970 c. I-6 and any lands which may in future be conveyed by the Province to Canada for the use and benefit of the Band and which are set aside by Canada for the use and benefit of the Band as reserves within the meaning of the Indian Act;

(18) Residue Gas means the substance remaining after raw Natural Gas has been processed to conform with the specifications common to the Gas Sales Contracts;

(19) Residue Gas Supply means the total volume, expressed in Mcf, of Residue Gas which is:

(a) derived from Natural Gas wheresoever produced, and

(b) acquired by Westcoast (whether through processing raw Natural Gas or by acquiring it in Residue Gas form) for the purpose of supplying Natural Gas pursuant to its Gas Sales Contracts.

(20) Shrinkage means the amount by which the Residue Gas Supply acquired by Westcoast in a Production Month exceeds the total of the volume in Residue Gas sold by Westcoast during such month pursuant to the Gas Sales Contracts;

(21) Subject Gas means all Natural Gas, the production of which is attributable to the lands included within the Reserve, notwithstanding that surface rights in the said lands may be vested in the Province, any other person, or in Canada other than for the use and benefit of the Band;

(22) Zero Line means the perimeter of the pay zone of the Clarke Lake Field as outlined in blue on Schedule “C” attached hereto.

2 DECLARATION

This Agreement applies to:

(1) all Excepted Minerals,

(2) all minerals precious or base, including coal, Petroleum, and Natural Gas, which underlie lands that may hereafter be conveyed by the Province to Canada for the use and benefit of the Band as a Reserve, and

(3) all other minerals which are in, upon or under the lands conveyed by the Province to Canada in trust for the use and benefit of the Band by British Columbia Order-in-Council No. 2995 dated the 28th day of November, 1961, or which underlie lands that may hereafter be granted by the Province to Canada for the use and benefit of the Band as a Reserve;

all of which minerals are hereinafter referred to as the “Subject Minerals”.

3 MINERALS

All minerals as defined in the Indian Reserves Mineral Resources Act, R.S.B.C. 1960, c. 187 in, upon or under the Reserve and all rights and claims thereto shall be administered as though specifically subjected to and included in:

(1) the Agreement made between Canada and the Province and ratified by Canada by the British Columbia Indian Reserves Mineral Resources Act, S.C. 1943, c. 19 and by the Province by the Indian Reserves Mineral Resources Act, and

(2) any amendment to the said Agreement and the said statutes or any statutes substituted therefore;

but if at any time an Indian Agent is not appointed for the Reserve the powers and duties exercisable by an Indian Agent under the said Agreement with respect to such minerals shall be exercised by the Minister of Indian Affairs and Northern Development of Canada or any person authorized to act on his behalf.

4 The ownership, administration and control of all peat, limestone, marble, clay, gypsum, or any building stone when mined for building purposes, earth, ash, marl, gravel, sand or any element which forms part of the agricultural surface of the land in, upon or under the Reserve and all revenues derived therefrom shall be in Canada for the use and benefit of the Band.

5 TIMBER AND LIME

The ownership, administration and control of all timber and lime in, upon or under the Reserve shall be in Canada for the use and benefit of the Band, provided however, that the Province shall have the like powers to take timber and lime from the Reserve as are provided under British Columbia Order-in-Council No. 1036 of 1938 and Dominion P.C. Order No. 208 of 1930.

6 COAL, PETROLEUM AND NATURAL GAS — REVENUE SHARING

(1) The ownership, administration, control and power of disposition of coal, Petroleum and Natural Gas underlying the Reserve are vested in the Province and all claims and rights thereto shall be subject to the laws of the Province save as herein provided.

(2) The Province shall continue to collect all revenue from the disposition in any manner of coal, Petroleum and Natural Gas underlying the Reserve and the claims and rights thereto, whether by way of purchase money, rent, royalty, license, drilling reservation, permit or recording fees or otherwise, and whether directly or through an agent of the Crown in right of the Province in accordance with the law from time to time in force; but this shall not include any revenue derived from disposition of the surface of the Reserve.

(3) The net profit and gross revenue from the disposition of coal, Petroleum and Natural Gas underlying the Reserve and all claims and rights thereto shall be shared equally between Canada for the use and benefit of the Band, and the Province.

(4) The net profit and gross revenue from the disposition of coal and Petroleum and all claims and rights pertaining to the equal sharing thereof shall be determined by agreement between Canada and the Province as and when required, and failing agreement, equal sharing in accordance with subparagraph (3) hereof shall be determined by arbitration as provided in paragraph 12 hereof.

(5) The net profit and gross revenue from the disposition of Natural Gas and all claims and rights pertaining to the equal sharing thereof in accordance with subparagraph (3) hereof shall be determined in the manner hereinafter provided.

(6) The Province shall pay to Canada for the use and benefit of the Band the sum of $4,329,377.00 as hereinafter provided, in full satisfaction of all claims, rights and demands, if any, which Canada may have either in its own right or for the use and benefit of the Band:

(a) in, to, or in respect of the Subject Minerals as reduced to possession, or

(b) for any moneys whatsoever connected with the exploration, development, production, leasing or in any way disposing of or dealing with the Subject Minerals

before eight A.M. (P.S.T.) January 1, 1977.

(7) No interest shall be payable to Canada in its own right or for the use and benefit of the Band in respect of the said sum of $4,329,377.00 prior to the date of execution of this Agreement.

(8) The said sum of $4,329,377.00 shall be paid by the Province to Canada for the use and benefit of the Band forthwith upon the execution of this Agreement.

(9) The Province shall pay to Canada, for the use and benefit of the band, in full satisfaction of all claims, rights and demands, if any which Canada may have either in its own right or for the use and benefit of the Band

(a)(i) in, to, or in respect of the Subject Minerals as reduced to possession, or

(ii) for any moneys whatsoever connected with the exploration, development, production, leasing or in any way disposing of or dealing with the Subject Minerals,

from eight A.M. (P.S.T.) January 1, 1977, to eight A.M. (P.S.T.) on the date of execution of this Agreement, one-half of all moneys received by the Province in each Production Month, after eight A.M. (P.S.T.) January 1, 1977 to the date of execution of this Agreement in respect of

(b)(i) the net profit derived from the disposition of Natural Gas underlying the Reserve,

(ii) the amounts (hereinafter called “gross revenue”) received by the Province on any disposition of any interest by the Province with respect to Petroleum and Natural Gas underlying lands included in the Reserve, in accordance with the Petroleum and Natural Gas Act, S.B.C., 1965, c. 33 notwithstanding that surface rights in the said lands may be vested in the Province, any other person, or in Canada other than for the use and benefit of the Band (such interest including permits, licences, drilling reservations and leases or otherwise and all amounts derived by the Province as rentals in respect of any of the aforesaid interests and including fees charged pursuant to the Petroleum and Natural Gas Act for the renewal of such interests and the recording of same, but not including any revenue derived from disposition of the surface of the Reserve).

(10) The Province shall pay to Canada for the use and benefit of the Band the moneys referred to in subparagraph (9) hereof together with interest forthwith upon the execution of this Agreement provided, however, that that portion of the said moneys for those three Production Months up to and including the Production Month in which this Agreement is executed by Canada and the Province shall be paid by the Province to Canada no later than 90 days after the date of execution of this Agreement.

(11) The Province shall pay to Canada, for the use and benefit of the Band, in the manner provided in paragraph 7 hereof, one-half of the net profit derived from the disposition, in any manner whatsoever, after eight A.M. (P.S.T.) on the date of execution of this Agreement, of Natural Gas, the production of which is attributable to lands which, at the time of such production are included in the Reserve, notwithstanding that surface rights in the said lands may be vested in the Province, any other person, or in Canada other than for the use and benefit of the Band, and shall retain one-half of such net profits in its own right.

(12) The gross revenue as defined in subparagraph (9)(b)(ii) hereof, received by the Province after eight A.M. (P.S.T.) on the date of execution of the Agreement, shall be calculated by the Province and one-half thereof shall be paid by the Province to Canada, for the use and benefit of the Band, within ninety (90) days after the same shall have been received.

(13) Any dispute between the parties as to the amount of any moneys to be remitted to Canada for the use and benefit of the Band pursuant to subparagraph (11) or (12) hereof may, at the instance of either party, be referred to arbitration pursuant to paragraph 12 hereof.

7 NATURAL GAS NET PROFIT FORMULA

(1) For the purposes of this Agreement, the amount of Net Profit derived by the Province, including agencies of the Province, from the disposition of Natural Gas underlying the Reserve shall be determined separately in respect of each Production Month, in accordance with the steps set forth in this paragraph 7, but for the purposes of making the calculations under each of the steps it is agreed that whenever Subject Gas is intermingled with Other Gas (that is, Natural Gas which is not Subject Gas) the Subject Gas shall for all such purposes be deemed to be apportioned among each of the Domestic Utilities and the Foreign Utility in the same proportions as deemed for the purposes of calculating the volume of British Columbia-produced gas sold and delivered under Licence GL-41, (as amended from time to time) issued by the National Energy Board (herein called the “NEB”) and for the settling of accounts between Westcoast and the Petroleum Corporation pursuant to either the Basic Agreement as amended from time to time or the directions of the NEB.

Step One

Determine the Domestic Price (“DP”) for the Production Month which is the subject of the calculation (the Production Month which is the subject of the calculation being referred to herein as the “Subject Month”) by use of Alternative One hereunder until the date of execution of this Agreement, and thereafter by use of whichever of Alternative One and Alternative Two will produce the greater Domestic Price in the Subject Month.

Alternative One

By use of the formula

DP = P/V

where

- P

- = The total amount of money payable by the Domestic Utilities to Westcoast for the Sales Volume (that is, the volume of Natural Gas produced in British Columbia and purchased by the Domestic Utilities during the Subject Month);

- V

- = The Sales Volume expressed in Mcf.

Alternative Two

By the use of the formula

DP = CS+CG+1¢ (one cent);

where

- CS and CG

- have the meanings assigned to them in Step Three of this paragraph 7.

Step Two

Calculate the Average Price (“AP”) by use of the formula

AP = (DP×a) + (EP×b)

where

- DP

- = Domestic Price determined according to Step One;

- a

- = Domestic Sales (that is, the volume of Natural Gas sold and delivered to the Domestic Utilities) during the Subject Month, stated as a percentage of Total Sales (defined below) for that month;

- b

- = Export Sales (that is, the volume of Natural Gas produced in British Columbia and delivered to the US-Canada boundary pursuant to NEB Licence GL-41, as amended from time to time) for the Subject Month, stated as a percentage of Total Sales;

- EP

- = The total amount payable to Westcoast by Northwest Pipeline Corporation, the successors to or assigns of the right to purchase gas under NEB Licence GL-41 for the Export Sales made during the Subject Month divided by the volume of such sales expressed in Mcf.

Total Sales, where used in the paragraph 7, means the total of Domestic Sales and Export Sales for the Subject Month expressed in Mcf.

Step Three

Calculate Net Profit (“NP”) by use of the formula

NP = (GP-Sh) × (AP-(CS+CG))

where

- GP

- = the number of Mcf of Residue Gas derived from Subject Gas produced during the Subject Month;

- Sh

- = the number of Mcf which is that percentage of GP which Shrinkage during the Subject Month is of the Residue Gas Supply for that month;

- AP

- = Average Price calculated as aforesaid in respect of the Subject Month;

- CS

- = the total of the following:

(i) all sums which Westcoast is entitled (either by virtue of the Basic Agreement as amended from time to time or the orders of the National Energy Board) to recover from the Petroleum Corporation in respect of the handling (including gathering, processing and transmission) of Natural Gas during the Subject Month,

(ii) all costs (other than those referred to in either clause (i) of this definition of CS or in the definition of CG) incurred by the Petroleum Corporation in the course of its operations during the Subject Month,

expressed in an amount per Mcf of Total Sales as defined in Step Two, during the Subject Month;

- CG

- = the amount of money paid or payable by the Petroleum Corporation for the purchase during the Subject Month of Subject Gas, expressed as an amount per Mcf of Subject Gas sold and delivered during the Subject Month (that is, GP-Sh); which amount shall include the holdback, if any, made by the Petroleum Corporation (on the purchase of Old Gas) in accordance with the provisions of the gas purchase contracts dealing with Old Gas Credits as therein defined.

(2) That portion of the Net Profit derived in respect of a given Production Month which is payable to Canada as aforesaid shall be paid by the Province to Canada within ninety (90) days after the end of such month.

(3) If a Pool lies partly under the Reserve and partly under other lands, the proportion of the amount of Natural Gas produced during a Production Month from that Pool which is attributable to lands included within the Reserve shall be deemed to be equal to the proportion which the recoverable reserves of Natural Gas contained in that part of the Pool underlying the Reserve bears to the total amount of recoverable reserves of Natural Gas in the Pool.

(4) It is agreed that 7.44% of the total amount of Natural Gas in the Clarke Lake Field based upon the present Zero Line shall be deemed to be the Band’s share thereof.

(5) If in the future it is determined that the actual boundaries of the Natural Gas Pool defined herein as the Clarke Lake Field extend beyond the lands described in Schedule “C”, the agreed percentage set out in subparagraph (4) of paragraph 7 hereof shall be adjusted accordingly between the parties, and, failing agreement, shall be settled by arbitration pursuant to paragraph 12 hereof.

8 BOOKS AND RECORDS

(1) Whenever any moneys are paid hereunder by the Province to Canada they will be accompanied by a statement showing the manner in which such moneys were calculated.

(2) The Province and its agents will keep proper books and records of the calculation and the receipt of revenues and profits pursuant to this Agreement, and will make such books and records available to audit and inspection by Canada or its agent, and will allow Canada or its agent to make copies thereof and take extracts therefrom, and will furnish Canada or its agent with such additional information relevant to the calculation and receipt of revenues and profits hereunder as Canada or its agent may reasonably require.

9 PETROLEUM AND NATURAL GAS — ENTRY AND ARBITRATION

(1) The administration and control of the surface of the Reserve remains in Canada for the use and benefit of the Band.

(2) Subject to subparagraph (6) hereof, any agreement in force at the date of execution of this Agreement whereby Canada granted rights of entry to the Reserve for the purpose of Petroleum or Natural Gas exploration, development or production, or any other purpose, shall remain in effect as though this Agreement had not been executed.

(3) Canada, in its own right and on behalf of the Band, agrees to conclude agreements providing rights of entry to the Reserve to those persons licensed by the Province to explore for, develop or produce Petroleum or Natural Gas within the Reserve as of the date of execution of this Agreement.

(4) The Province shall consult with Canada and the Band prior to the posting of any location within the Reserve for disposition by Crown reserve sale. In order to provide for such consultation, the Province shall give to Canada and the Band written notice of its intention to post a location within the Reserve at least 45 days prior to such posting. Within 21 days of receipt of such notice, Canada shall advise the Province in writing of any concerns or objections which Canada or the Band may have to such posting. Within 10 days thereafter, Canada and the Province shall discuss such concerns or objections. The Province may, at its option, defer the posting of a location within the Reserve in order to permit such discussions to continue after the expiry of the 45 day notice period stipulated herein, PROVIDED HOWEVER that nothing contained in this subparagraph (4) shall limit the right of the Province, in its sole discretion, to proceed with the posting of a location at any time after the expiry of the said 45 day notice period.

(5) Where, after the date of execution of this Agreement, a person is licensed by the Province to explore for, develop or produce Petroleum or Natural Gas within the Reserve, Canada in its own right and on behalf of the Band and any other person whose rights, titles or interests in the Reserve may be affected by the grant of rights of entry, occupation or use necessary to conduct such exploration, development, or production shall, subject to subparagraph (6) hereof, conclude agreements providing rights of entry, occupation or use to the Reserve to such person so licensed by the Province.

(6) Any dispute between Canada in its own right or on behalf of the Band or any person required by subparagraph (5) hereof to grant rights of entry, occupation or use of the Reserve and a person licensed by the Province to explore for, develop or produce Petroleum or Natural Gas within the Reserve, respecting the terms and conditions of entry, occupation or use of the Reserve for the purpose of exploring for, developing, producing or storing Petroleum or Natural Gas or any purpose connected therewith or incidental thereto, or the amount of rent or compensation for such entry, occupation and use of the Reserve shall be referred to arbitration in accordance with subparagraph (7) hereof. The Province as owner of all Petroleum and Natural Gas underlying the Reserve shall be entitled to refer any disputes to arbitration and the provisions of subparagraph (7) hereof shall apply, mutatis mutandis, to such referral.

(7) Either party may refer a dispute to arbitration pursuant to subparagraph (6) hereof by giving the other party written notice of its intention to do so. Within 30 days of the service of such notice, each party shall appoint one arbitrator and the two arbitrators so appointed shall, within 45 days of the service of such notice, appoint a mutually acceptable arbitrator as Chairman. The three arbitrators so appointed shall arbitrate the dispute submitted.

(8) In determining disputes submitted to arbitration pursuant to subparagraph (6) hereof the arbitrator may consider:

(a) the compulsory aspect of the entry, occupation, or use;

(b) the value of the Reserve and the loss by Canada or the Band of any right or use or profit;

(c) the temporary and permanent damage resulting from the entry, occupation, or use;

(d) compensation for severance;

(e) compensation for nuisance and disturbance resulting from the entry, occupation, or use;

(f) any amount previously paid to Canada or the Band in respect of the entry, occupation or use;

(g) alternative means of entry, occupation, or use;

(h) alternative means of exploration, development or production;

(i) environmental impact of exploration, development or production;

(j) existing or proposed zoning of Reserve lands and existing or proposed land-use laws or by-laws of Canada or the Band;

(k) the effect of exploration, development or production on existing or proposed economic or social development programs of Canada or the Band;

(l) such other factors as the arbitrator deems applicable.

(9) The procedure for the conduct of the arbitration shall be determined solely by the arbitrator.

(10) The decision of the arbitrator shall be final and binding on the parties.

10 RELEASE

In consideration of this Agreement, and in particular the agreement of the Province to share equally with Canada for the use and benefit of the Band the net profit, gross revenue, royalties or any like proceeds from the disposition of the Subject Minerals as herein provided, Canada in its own right and on behalf of the Band releases any and all claims to any right, title or interest whatsoever which Canada or the Band ever had, now has, or hereafter can, shall, or may have to the Subject Minerals or any moneys arising from the exploration, development, production, leasing or in any way disposing of or dealing with the Subject Minerals.

11 CHANGE OF CIRCUMSTANCES AND IMPOSSIBILITY OF PERFORMANCE

(1) In the event that any provision of this Agreement becomes impossible of performance or is otherwise frustrated and Canada and the Province are thereby discharged from further performance of it, the said parties mutually agree that the remainder of the Agreement shall remain in full force and effect and be binding upon the said parties, and that the said provision shall be renegotiated upon such terms and conditions as may be mutually agreed upon, and that Canada, in its own right and on behalf of the Band, and the Province will proceed as soon as possible thereafter to enter into negotiations for the purpose of renegotiating the said provision and use their best endeavours to bring such negotiations to a mutually satisfactory and speedy conclusion. The said parties agree that any such renegotiated provision shall be and shall be deemed to have been in full force and effect and binding upon the parties hereto from and including that date upon which such provision became impossible of performance or was otherwise frustrated as aforesaid, and that the Agreement as amended by the renegotiated provision shall continue to provide that Canada, for the use and benefit of the Band, and the Province shall share equally the net profits, gross revenue, royalties or any like proceeds from the disposition of coal, Petroleum and Natural Gas underlying the Reserve and all claims and rights thereto.

(2) Any dispute between the said parties as to whether any provision of the Agreement has become impossible of performance or is otherwise frustrated and Canada and the Province are thereby discharged from further performance of it shall, at the instance of either party, be referred to arbitration pursuant to paragraph 12 hereof.

(3) In the event that Canada and the Province fail to renegotiate any provision of the Agreement which becomes impossible of performance or is otherwise frustrated as provided for in subparagraph (1) hereof, within twelve (12) weeks of the commencement of negotiations for that purpose, the matter may be referred to a Judge for final determination and the provisions of paragraph 12 hereof shall apply, mutatis mutandis, to such referral.

(4) In the event that a change of circumstances not amounting to frustration of this Agreement prevents the parties from sharing equally in the net profit derived by the Province from the disposition of Natural Gas underlying the Reserve, the Province and Canada agree to renegotiate the Natural Gas Net Profit Formula in paragraph 7 hereof or any other relevant provision of this Agreement. In particular, and without restricting the generality of the foregoing, the Province and Canada agree to renegotiate the Natural Gas Net Profit Formula or any other relevant provision of this Agreement to ensure an equal sharing of Net Profit from the disposition of Natural Gas underlying the Reserve in the event that any new contracts are made for the sale of Natural Gas to the United States market. In the event that Canada and the Province fail to renegotiate such provision within 12 weeks of the commencement of negotiations for that purpose, the matter may be referred to a Judge for final determination and the provisions of paragraph 12 hereof shall apply, mutatis mutandis, to such referral.

12 ARBITRATION

(1) Notwithstanding the Federal Court Act, R.S.C. 1970, 2nd supplement Chapter 10, or the Federal Courts Jurisdiction Act, R.S.B.C. 1960, Chapter 141, any dispute between Canada and the Province as to the interpretation or application of any of the provisions of this Agreement and all disputes that may arise between the parties as a consequence of this Agreement being entered into, except those disputes referred to in paragraph 9(6) hereof, may, upon thirty (30) days’ notice, be referred by either Canada or the Province to arbitration by a Judge.

(2) Referral of an issue to arbitration shall be by application to the Chief Justice of the Supreme Court of British Columbia who shall designate a Judge as arbitrator.

(3) The procedure for the conduct of the arbitration shall be determined solely by the Judge so designated, provided, however that he shall hear the parties, shall hear evidence, shall determine the issue between the parties, may consult experts, and is empowered to award compensation.

(4) The arbitrator shall determine any dispute submitted to arbitration pursuant to this Agreement and the arbitrator in determining a dispute shall have regard inter alia to the following considerations:

(a) in determining a dispute submitted to arbitration pursuant to paragraphs 6(4), 6(13), 11(2), 11(3) and 11(4) the arbitrator shall consider the principle underlying this Agreement that the net profit, gross revenue, royalties or any like proceeds from the disposition of coal, Petroleum and Natural Gas shall be shared equally between Canada for the use and benefit of the Band, and the Province;

(b) in determining a dispute under paragraph 7(5) the arbitrator shall consider general geological and engineering principles and those particular principles concerning the recoverability of gas or gases.

(5) The decision of the arbitrator shall be final and binding on the parties.

(6) The provisions of the Arbitration Act, R.S.B.C. 1960, c. 14, except such as are inconsistent with any of the provisions of this Agreement, shall apply to a submission to arbitration pursuant to this Agreement.

13 SURRENDER BY THE BAND

The rights, duties and obligations created by this Agreement are conditional upon Canada obtaining from the Band, in accordance with the provisions of the Indian Act, a surrender in the form attached as Schedule “B” hereto. In the event that Canada does not obtain such surrender this Agreement shall be null and void as if it had never been executed.

14 SPECIAL LEGISLATION

Canada shall recommend to Parliament and the Province shall recommend to the Legislative Assembly of British Columbia, special legislation giving effect to, declaring valid, and, where necessary, giving force of law to the provisions of this Agreement with effect as of January 1, 1977, and Canada and the Province shall take all other necessary measures to implement the terms of this Agreement.

15 COMING INTO FORCE OF AGREEMENT

This Agreement shall come into force as of January 1, 1977.

16 INTERIM FINANCIAL PROVISIONS

(1) All monies payable under this Agreement by the Province to Canada for the use and benefit of the Band shall, until the passage of the federal and provincial legislation referred to in paragraph 14 hereof, be paid by the Province into a separate account under the joint direction of Canada and the Province, such joint direction being in substantially the same form as contained in Schedule “D” of this Agreement.

(2) Within thirty (30) days of the passage of the federal or provincial legislation referred to in paragraph 14 hereof, whichever is the later date, Canada and the Province shall take all necessary steps to transfer all monies so held, together with all accumulated interest, to Canada for the use and benefit of the Band in accordance with paragraph 6 hereof.

(3) In the event that either the federal or provincial legislation referred to in paragraph 14 hereof is not passed within two (2) years of the date of execution of this Agreement, Canada and the Province shall take all necessary measures to transfer all monies held in such account, together with all accumulated interest, to the Province and this Agreement shall be null and void as and from January 1, 1977.

17 HOUSE OF COMMONS CLAUSE

No member of the House of Commons shall be admitted to any share or part of this Agreement or to any benefit arising therefrom.

18 AMENDMENTS

The parties, upon the recommendation of the Band, pursuant to a referendum conducted in accordance with the provisions of the Indian Act, may, with the consent of the Governor-General in Council and the Lieutenant-Governor in Council, amend this Agreement.

19 METRIC CONVERSION

The parties agree that on and after 8 A.M. (P.S.T.) January 1, 1979 all calculations for the determination of net profits and gross revenue shall be made using the International System of Units (SI) where such units have been or may be adopted in the Province from time to time, utilizing the conversion factors adopted by the Province.

20 NOTICES

Any notice or other written communication required or permitted to be given pursuant to this Agreement may be given as follows:

(1) To Canada,

Assistant Deputy Minister,

Indian & Inuit Affairs Program,

Department of Indian Affairs and Northern Development,

Terrasses de la Chaudière,

10 Wellington St.,

Hull, Quebec.

(2) To the Province,

Provincial Secretary of British Columbia,

Parliament Buildings,

Victoria, British Columbia.

Either Canada or the Province may at any time and from time to time notify the other in writing as to a change of address and the new address to which notice shall be given to it thereafter until further changed.

21 INTERPRETATION

In this Agreement:

(a) Words in the singular include the plural and words in the plural include the singular;

(b) Words importing male persons include female persons and corporations.

IN WITNESS WHEREOF the Honourable Jake Epp, Minister of Indian Affairs and Northern Development, has hereunto set his hand on behalf of Canada, the Honourable L. Allan Williams, Attorney-General, and the Honourable Robert A. McClelland, Minister of Energy, Mines and Petroleum Resources, respectively, have hereunto set their hands on behalf of the Province, all this 7th day of January, 1980.

SIGNED on behalf of HER MAJESTY THE QUEEN IN RIGHT OF CANADA represented herein by the Honourable Jake Epp, Minister of Indian Affairs and Northern Development in the presence of:

George Behn

SIGNED on behalf of HER MAJESTY THE QUEEN IN RIGHT OF THE PROVINCE OF BRITISH COLUMBIA represented herein by the Honourable L. Allan Williams and the Honourable Robert A. McClelland in the presence of:

George Behn

SCHEDULE “A”

THAT the Minister of Indian Affairs and Northern Development order a referendum to be held at the earliest date possible to determine if the majority of electors of the Fort Nelson Indian Band are in favor of the surrender to Her Majesty of those rights only necessary to fulfill the terms set out in that form of agreement as negotiated between the Government of Canada, the Government of British Columbia and the Fort Nelson Indian Band Council, a copy of which agreement is attached hereto.

AND FURTHER BE IT RESOLVED THAT the Council of the Fort Nelson Indian Band approves the said agreement for execution by the Minister of Indian Affairs and Northern Development on the condition that the said agreement is effective and binding upon the Fort Nelson Indian Band only if the majority of the electors of the Fort Nelson Indian Band are in favor of the said agreement and surrender.

SCHEDULE “B”Instrument of Surrender

WHEREAS His Honour the Lieutenant-Governor in Council of the Province of British Columbia did by Order in Council No. 2995 approved 28 November, 1961 convey the lands therein mentioned, when surveyed, to Her Majesty the Queen in Right of Canada in trust for the use and benefit of the Fort Nelson Indian Band (herein referred to as the “Band”) subject, inter alia to the provisions and reservations set forth in Form No. 12 of the Schedule to the Land Act, R.S.B.C. 1960, Chapter 206;

AND WHEREAS His Excellency the Governor-General in Council did by Order in Council Number P.C. 1966-1978 of 20 October, 1966, a copy of which is hereto attached, set apart the said lands for the use and benefit of the Fort Nelson Indian Band;

AND WHEREAS lands continue to be held by Her Majesty the Queen in Right of Canada for the use and benefit of the Fort Nelson Indian Band (herein referred to as the “Reserve”) which lands are more particularly described in Annex “A”;

AND WHEREAS disputes have arisen between Canada in its own right and on behalf of the Band, and the Province as to the ownership of any minerals precious or base including coal, petroleum and gas or gases underlying the Reserve;

AND WHEREAS representatives of the Band and the Province have negotiated the Agreement hereto attached as Annex “B” (herein referred to as the “Settlement Agreement”), which would settle the disputes as to the ownership of any minerals precious or base including coal, petroleum and any gas or gases underlying the Reserve;

AND WHEREAS the Settlement Agreement must be confirmed by Her Majesty in Right of Canada and the Province by special legislation and Her Majesty in Right of Canada requires, as a condition of the signature of the Settlement Agreement and prior to the passage of special legislation, the approval of the Band expressed by a surrender to Her Majesty in Right of Canada pursuant to the provisions of the Indian Act R.S.C. 1970 c. I-6;

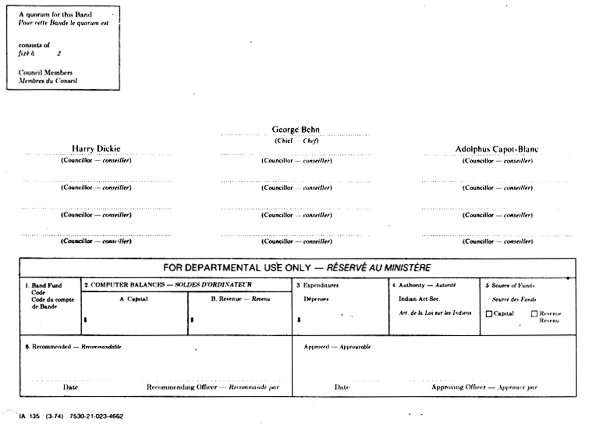

NOW THEREFORE KNOW ALL MEN BY THESE PRESENTS that we the undersigned Chief and Councillors of the Fort Nelson Band of Indians, for and acting on behalf of the people of our said Band, in accordance with the provisions of the Indian Act and by virtue of the assent to surrender by the membership of the Band in a referendum held on the 18th day of February, 1980 in accordance with the Indian Referendum Regulations P.C.: 1958-1451 the results of which referendum are evidenced by the statement of the electoral officer and the Chief of the Band attached as Annex “C”, do hereby make the following surrender to Her Majesty the Queen in Right of Canada on the conditions and terms listed below:

(1) The Band surrenders unto Her Majesty the Queen in Right of Canada, Her Heirs and Successors, all our interests, rights, claims and demands, if any, in respect of all minerals, precious or base, including coal, petroleum and any gas or gases, which may be found in, upon or under the lands described as “the Reserve” in Annex “A” and approves the entry by Her Majesty the Queen in Right of Canada as represented by the Minister of Indian Affairs and Northern Development with the Province of British Columbia, into the Settlement Agreement;

(2) The Band surrenders unto Her Majesty the Queen in Right of Canada, Her Heirs and Successors such of the surface as is necessarily incidental to the exploitation of coal, petroleum and any gas or gases, which may be found in, upon or under the lands described as “the Reserve” in Annex “A”.

TO HAVE AND TO HOLD the same unto Her Majesty the Queen in Right of Canada, Her Heirs and Successors for the following purposes:

(a) to enter into the Settlement Agreement which acknowledges that ownership, administration, control and power of disposition of coal, petroleum and natural gas as defined in the Settlement Agreement are vested in the Province, and provides for an equal sharing in the revenue as defined in the Settlement Agreement from such coal, petroleum and natural gas between Canada for the use and benefit of the Band and the Province;

(b) to enter into the Settlement Agreement which provides that the minerals as defined in the British Columbia Indian Reserves Mineral Resources Act which are found in the Reserve be dealt with as if subject to that Act;

(c) to grant in accordance with the Settlement Agreement leases, licences of occupation, rights of way and easements, or other rights of entry over the surface of any part of the Reserve for the purposes of the exploration, exploitation or production of coal, petroleum and any gas or gases, or for access to such minerals or for the transportation of such minerals whether by pipeline or otherwise and upon such terms and conditions as are necessary to comply with the Settlement Agreement;

(d) to make such other grants and to do such other acts and things as may be required by the Settlement Agreement or necessarily incidental to its implementation;

(e) to grant to the Province the Release in accordance with paragraph 10 of the Settlement Agreement of any and all claims to any right, title or interest whatsoever which Canada or the Band ever had, now has, or hereafter can, shall, or may have to the Subject Minerals or any moneys arising from the exploration, development, production, leasing or in any way disposing of or dealing with the Subject Minerals.

PROVIDED that all moneys received from any lease, licence, right of way, easement or other grant or disposition of surface rights mentioned in the preceding paragraphs shall be payable to Canada for the use and benefit of the Band.

AND PROVIDED FURTHER that pursuant to the direction of the Band expressed in the Referendum Vote, the Band releases and discharges Her Majesty from all actions, proceedings, claims and demands whatsoever which the Band now has or at any time may have but for execution of the Settlement Agreement as regards any minerals, precious and base, including coal, petroleum and any gas or gases, which may be found in, upon or under the Reserve.

AND UPON the condition that, subject to the acceptance of this surrender by His Excellency the Governor-General in Council, this surrender will come into force upon the coming into force of the Settlement Agreement.

AND we the undersigned Chief and Councillors of the Fort Nelson Band of Indians, for and acting on behalf of the people of our said Band in Council assembled, do hereby approve, consent to and ratify the Settlement Agreement, between Her Majesty the Queen in Right of Canada and Her Majesty the Queen in Right of the Province of British Columbia.

AND we the undersigned Chief and Councillors of the Fort Nelson Band of Indians do on behalf of our people and for ourselves hereby ratify and confirm whatever Her Majesty the Queen in Right of Canada may do, or cause to be done in regard to these presents or the said Agreement.

IN WITNESS WHEREOF we have hereunto set our hands and affixed our seals this 18th day of February in the year of Our Lord One Thousand Nine Hundred and Eighty.

SIGNED, SEALED AND DELIVERED

in the presence of:

Adolphus Capot-Blanc

George Behn

Harry Dickie

Witness as to all signatures

Karen M. Copp

SCHEDULE “D”Joint Instrument of Direction

(Name of Institution where monies held)

Dear Sirs:

You are hereby directed, upon receipt of this joint instrument of direction, to hold the deposit of (amount) represented by certificate number  held in account number

held in account number  and all further deposits in such account together with all interest payable from time to time on such deposits on the following terms, unless otherwise directed by the parties hereto by a joint letter of instruction:

and all further deposits in such account together with all interest payable from time to time on such deposits on the following terms, unless otherwise directed by the parties hereto by a joint letter of instruction:

- 1All deposits referred to above and all interest payable from time to time on such deposits shall continue to be held on deposit with you in the joint name of Her Majesty the Queen in Right of Canada (hereinafter called “Canada”) and Her Majesty the Queen in Right of the Province of British Columbia (hereinafter called “the Province”).

- 2Prior to any maturity date, and subject to any penalties stipulated as to interest, the said deposit or any part thereof may be retired and replaced by other deposits of the Bank of a no less secure nature, at the sole discretion of Canada and the Province, provided that:

(a) Maturity of such replacement deposits shall be in accordance with the provisions hereof;

(b) Principal interest of such replacement deposits shall be dealt with as herein provided;

(c) All such replacement deposits shall be in the name of Canada and the Province.

- 3Within thirty (30) days of the passage of the federal or provincial legislation (whichever is later in time) referred to in paragraph 14 of the Agreement between Canada and the Province attached as Annex “A” the parties hereto shall execute a joint letter of instruction instructing the transfer of all monies held on deposit at that time together with all accumulated interest to Canada for the use and benefit of the Fort Nelson Indian Band in accordance with the said Agreement.

- 4In the event that Canada fails to obtain from the Fort Nelson Indian Band the surrender referred to in paragraph 13 of the Agreement within 6 months from the date of execution of that Agreement, the Province and Canada shall execute a joint letter of instruction to transfer all monies held on deposit together with all accumulated interest to the Province and the bank shall forthwith make such transfer.

- 5In the event that the special legislation referred to in paragraph 14 of the Agreement is not passed within two (2) years of the execution of the Agreement, the parties hereto shall execute forthwith following the expiry of the two year period a joint letter of instruction instructing that all sums held on deposit up until that time, together with all accumulated interest, be transferred to the Province in accordance with the Agreement.

- 6This letter of instruction cannot be revoked or amended except by a letter of instructions jointly executed by Canada and the Province.

Yours very truly,

HER MAJESTY THE QUEEN IN RIGHT OF CANADA

Per:

HER MAJESTY THE QUEEN IN RIGHT OF THE PROVINCE OF BRITISH COLUMBIA

Per:

INSTITUTION WHERE MONIES HELD ON DEPOSIT

Per:

- Date modified: