Canada Deposit Insurance Corporation Differential Premiums By-law

SCHEDULE 2(Sections 1, 6, 12, 15, 16 and 20 to 27)

PART 1Interpretation

- 1

(1) The following definitions apply in this Schedule:

- Guidelines

Guidelines means

(a) in the case of a bank or a federal credit union, the Guidelines for Banks; and

(b) in the case of any other member institution, the Guidelines for Trust and Loan Companies. (Lignes directrices)

- regulated deposit-taking institution

regulated deposit-taking institution means an entity that is supervised or regulated by a Canadian or foreign financial services or banking regulator and is authorized to accept deposits from the public. (institution de dépôt réglementée)

(2) For the purposes of item 7 of the Reporting Form, the value of assets acquired by a member institution, as a result of a merger or an acquisition described in that item, is the value of the assets on the date of their acquisition as reported in the consolidated financial statements of the member institution.

PART 2Reporting Form

| 1 CAPITAL ADEQUACY MEASURES |

Refer to the Leverage Requirements Return (LRR) and Basel III Capital Adequacy Reporting – Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. |

| 1.1 Leverage Ratio (%) Indicate the leverage ratio (%) as set out in Section 1 – Leverage Ratio Calculation of the LRR. 1.1 |

| 1.2 Authorized Leverage Ratio (%) Indicate the authorized leverage ratio (%) as set out in Section 1 – Leverage Ratio Calculation of the LRR. 1.2 |

| 1.3 Tier 1 Capital Ratio (%) Indicate the Tier 1 capital ratio (%) as set out in Schedule 1 – Ratio Calculations of the BCAR form. 1.3 |

| 1.4 Minimum Tier 1 Capital Ratio Indicate the minimum Tier 1 capital ratio as set by the regulator for the member institution in accordance with the Capital Adequacy Requirements guideline of the Guidelines, but if a different minimum Tier 1 capital ratio has been set by the regulator by written notice sent to the member institution, indicate that ratio instead. 1.4 |

| 1.5 “All in” Target Tier 1 Capital Ratio Indicate the “all in” target Tier 1 capital ratio (including the capital conservation buffer and domestic systemically important bank surcharge as applicable) as set by the regulator for the member institution in accordance with the Capital Adequacy Requirements guideline of the Guidelines, but if a different “all in” target Tier 1 capital ratio has been set by the regulator by written notice sent to the member institution, indicate that ratio instead. 1.5 |

| 2 RETURN ON RISK-WEIGHTED ASSETS (%) | |

|---|---|

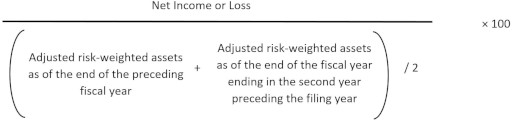

Formula: | |

| Complete the following: (2.1 — — — —) ÷ (( 2.2 — — — — + 2.3 — — — — ) / 2) × 100 = 2 | |

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the following documents:

| |

| 2.1 Net Income or Loss The net income or loss attributable to equity holders and non-controlling interests (the latter to be reported as a negative number) as set out in the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI. | |

| 2.2 Adjusted Risk-Weighted Assets as of the End of the Fiscal Year Ending in the Year Preceding the Filing Year Indicate the adjusted risk-weighted assets as set out in Schedule 1 – Ratio Calculations of the BCAR form. | |

| 2.3 Adjusted Risk-Weighted Assets as of the End of the Fiscal Year Ending in the Second Year Preceding the Filing Year Indicate the adjusted risk-weighted assets as of the end of the fiscal year ending in the second year preceding the filing year, calculated in the same manner as for element 2.2. If the member institution does not have a fiscal year ending in the second year preceding the filing year, it must indicate “zero”, unless it is an amalgamated institution described below. If the member institution is an amalgamated member institution formed by an amalgamation involving one or more member institutions and does not have a fiscal year ending in the second year preceding the filing year, it must indicate the same amount as for element 2.2. |

| 3 MEAN ADJUSTED NET INCOME VOLATILITY | |

|---|---|

If a member institution has been operating as a member institution for less than five fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 3, 3.1, 3.2 and 3.13 and fill in any of elements 3.3 to 3.12 that apply to it. If a member institution has been operating as a member institution for five or more fiscal years but less than 10 fiscal years consisting of at least 12 months each (with the last fiscal year of operation ending in the year preceding the filing year), it must complete the formula using the fiscal years during which it has been operating with the appropriate adjustment to the value of “n”. If a member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than three fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), in addition to filling in the applicable elements as an amalgamated member institution, it must also fill in the applicable elements for the amalgamating member institution. If a member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than three fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 3, 3.1, 3.2 and 3.13 and fill in any of elements 3.3 to 3.12 that apply to it. | |

| Formula: (Standard deviation of the net income or loss) ÷ (Mean net income or loss) | |

| Complete the following: (3.1 — — — —) ÷ (3.2 — — — —) = 3 | |

| Elements Use the instructions below to arrive at the elements of the formula. | |

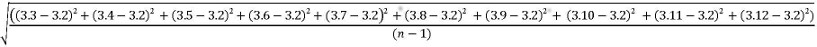

| 3.1 Standard deviation of the Net Income or Loss Determine the standard deviation of the net income or loss using the formula  If a member institution has been operating as a member institution for 12 or more fiscal years consisting of at least 12 months each, “n” will be equal to 10. If a member institution has been operating as a member institution for seven or more but less than 12 fiscal years consisting of at least 12 months each, for each year that it is not operating the portion of the formula in the numerator referencing that year would be removed and “n” will be equal to the number of years that it has been so operating less 2 (e.g, if operating for 11 years, remove “(3.12 – 3.2)2” from the numerator and “n” will be equal to 9). If a member institution has been operating as a member institution for six fiscal years consisting of at least 12 months each, “+ (3.7 – 3.2)2 + (3.8 – 3.2)2 + (3.9 – 3.2)2 + (3.10 – 3.2)2 + (3.11 – 3.2)2 + (3.12 – 3.2)2” must be removed from the formula and “n” will be equal to 4. If a member institution has been operating as a member institution for five fiscal years consisting of at least 12 months each, “+ (3.6 – 3.2)2 + (3.7 – 3.2)2 + (3.8 – 3.2)2 + (3.9 – 3.2)2 + (3.10 – 3.2)2 + (3.11 – 3.2)2 + (3.12 – 3.2)2” must be removed from the formula and “n” will be equal to 3. | |

| 3.2 Mean Net Income or Loss Determine the mean net income or loss (the latter to be reported as a negative number) using the formula ((3.3 + 3.4 + 3.5 + 3.6 + 3.7 + 3.8 + 3.9 + 3.10 + 3.11 + 3.12)) ÷ n If a member institution has been operating as a member institution for 12 or more fiscal years consisting of at least 12 months each, “n” will be equal to 10. If a member institution has been operating as a member institution for seven or more but less than 12 fiscal years consisting of at least 12 months each, the portion of the formula in the numerator referencing the years that it was not operating is to be removed and “n” will be equal to the number of years that it has been so operating less 2 (e.g., if operating for 11 years, “+ 3.12” is removed from the numerator and “n” will be equal to 9). If a member institution has been operating as a member institution for six fiscal years consisting of at least 12 months each, “+ 3.7 + 3.8 + 3.9 + 3.10 + 3.11 + 3.12” must be removed from the formula and “n” will be equal to 4. If a member institution has been operating as a member institution for five fiscal years consisting of at least 12 months each, “+ 3.6 + 3.7 + 3.8 + 3.9 + 3.10 + 3.11 + 3.12” must be removed from the formula and “n” will be equal to 3. | |

| Net income or loss (the latter to be reported as a negative number) after tax for each of the last 10 fiscal years. Indicate the net income or loss as determined for element 2.1 for the fiscal year ending in the year preceding the filing year. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.3. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.4. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.5. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.6. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.7. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.8. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.9. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.10. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.11. Indicate the number of fiscal years that the member institution has been operating as a member institution (if less than 12). A member institution must report net income or loss for the last 10 fiscal years. If a member institution has been operating as a member institution for less than three fiscal years of at least 12 months each and it is a member institution formed by an amalgamation involving only one member institution, it must report the net income or loss of the amalgamating member institution for the three fiscal years or less preceding the amalgamation, as applicable. If a member institution has been operating as a member institution for less than five fiscal years of at least 12 months each, it must report “N/A” (“not applicable”) for the elements corresponding to the fiscal years for which it was not operating as a member institution. |

| 4 STRESS-TESTED NET INCOME | |

|---|---|

If a member institution has reported “N/A” (“not applicable”) in element 3.13, it must report “N/A” for elements 4A, 4B and 4.3. | |

| Formulas: (Net income or loss) – (1 × Standard deviation of the net income or loss) = Stress-tested net income using one standard deviation (Net income or loss) – (2 × Standard deviation of the net income or loss) = Stress-tested net income using two standard deviations | |

| Complete the following: Stress-tested net income using one standard deviation: 4.1 Stress-tested net income using two standard deviations: 4.1 | |

| Elements Use the instructions below to arrive at the elements of the formulas. | |

| 4.1 Net Income or Loss Net income or loss as determined for element 2.1. | |

| 4.2 Standard deviation of the Net Income or Loss The standard deviation of the net income or loss as determined for element 3.1. |

| 5 EFFICIENCY RATIO (%) | |

|---|---|

| Formula: (Total non-interest expenses) ÷ (Net interest income + Non-interest income) × 100 | |

| Complete the following: (5.1 — — — —) ÷ (5.2 — — — — + 5.3 — — — — ) × 100 = 5 | |

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI, Reporting Manual, completed in accordance with that Manual for the fiscal year ending in the year preceding the filing year. | |

| 5.1 Total Non-Interest Expenses Indicate the total non-interest expenses, as set out in the Consolidated Statement of Comprehensive Income, Retained Earnings and AOCI, less any charges for impairment included in that total. | |

| 5.2 Net Interest Income Determine the net interest income by adding (a) and (b): | |

|  |

|  |

Total (insert as element 5.2 of the formula) |  |

| 5.3 Non-Interest Income Determine the non-interest income by adding (a) and (b): | |

|  |

|  |

Total (insert as element 5.3 of the formula) |  |

| 6 NET IMPAIRED ASSETS TO TOTAL CAPITAL (%) |

|---|

| Formula: (Net impaired on-balance sheet assets + Net impaired off-balance sheet assets) ÷ (Total Capital) × 100 |

| Complete the following: (6.1 — — — — + 6.2 — — — —) ÷ (6.3 — — — —) × 100 = 6 |

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the following documents:

|

| 6.1 Net Impaired On-Balance Sheet Assets Indicate the net impaired on-balance sheet assets as set out for the total of the column “Net Impaired Amount” in the Return of Allowances for Expected Credit Losses. If the result is negative, report “zero”. |

| 6.2 Net Impaired Off-Balance Sheet Assets Calculate the net impaired off-balance sheet assets by subtracting the total of the column “Individual allowance for expected credit losses” in Table 6A from the total of the column “Credit equivalent amount” in that Table. If the result is negative, report “zero”. |

| 6.3 Total Capital Indicate the total capital set out in Schedule 1 of the BCAR form. |

Table 6A — Impaired Off-balance Sheet Assets

| Complete Table 6A as of the end of the fiscal year ending in the year preceding the filing year, referring to Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures and Schedule 40 – Derivative Contracts of the BCAR form and to the Capital Adequacy Requirements guideline of the Guidelines. | |||||

| Impaired Instruments | Notional principal amount a | Credit conversion factor b | Credit equivalent amount (a × b) | Individual allowance for expected credit losses | |

| Direct credit substitutes – excluding credit derivatives | 100% | ||||

|---|---|---|---|---|---|

| Direct credit substitutes – credit derivatives | 100% | ||||

| Transaction-related contingencies | 50% | ||||

| Short-term self-liquidating trade-related contingencies | 20% | ||||

| Sale & repurchase agreements | 100% | ||||

| Forward asset purchases | 100% | ||||

| Forward forward deposits | 100% | ||||

| Partly paid shares and securities | 100% | ||||

| NIFs & RUFs | 50% | ||||

| Undrawn commitments – excluding securitization exposure | Standardized Approach | 0% | |||

| 20% | |||||

| 50% | |||||

| Advanced IRB Approach | Footnote for Table 6A — Impaired Off-balance Sheet Assets ** | ||||

| Footnote for Table 6A — Impaired Off-balance Sheet Assets ** | |||||

| Footnote for Table 6A — Impaired Off-balance Sheet Assets ** | |||||

| Impaired OTC Derivative Contracts | |||||

| Credit derivative contracts | Footnote for Table 6A — Impaired Off-balance Sheet Assets * | ||||

| Interest rate contracts | Footnote for Table 6A — Impaired Off-balance Sheet Assets * | ||||

| Foreign exchange contracts | Footnote for Table 6A — Impaired Off-balance Sheet Assets * | ||||

| Equity-linked contracts | Footnote for Table 6A — Impaired Off-balance Sheet Assets * | ||||

| Commodity contracts | Footnote for Table 6A — Impaired Off-balance Sheet Assets * | ||||

| Other contracts | Footnote for Table 6A — Impaired Off-balance Sheet Assets * | ||||

| Total | |||||

| Use these totals to calculate element 6.2 | |||||

Return to footnote *Fill in the totals from Table 6B.

Return to footnote **Refer to the Capital Adequacy Requirements guideline of the Guidelines to determine the applicable credit conversion factor.

Table 6B — Impaired OTC Derivative Contracts

| Complete Table 6B as of the end of the fiscal year ending in the year preceding the filing year, referring to Schedule 40 – Derivative Contracts of the BCAR form and to the Capital Adequacy Requirements guideline of the Guidelines. | ||||||

| Impaired OTC Derivative Contracts (in thousands of dollars) | Credit derivative contracts | Interest rate contracts | Foreign exchange contracts | Equity-linked contracts | Commodity contracts | Other contracts |

| Potential Future Credit Exposure (PFE) | ||||||

| Total contracts not subject to permissible netting | ||||||

| Total contracts subject to permissible netting | ||||||

| Exposure at Default (EAD) (after taking into account collateral and guarantees) | ||||||

| Total contracts not subject to permissible netting | ||||||

| Total contracts subject to permissible netting | ||||||

| Total Impaired OTC Derivative Contracts (carry forward to “Credit equivalent amount” column in Table 6A) | ||||||

| 7 THREE-YEAR MOVING AVERAGE ASSET GROWTH (%) | |||

|---|---|---|---|

If a member institution has been operating as a member institution for less than six fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 7 and 7.5 but still fill in any of elements 7.1 to 7.4 that apply to it. If a member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than four fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), in addition to filling in the applicable elements as an amalgamated member institution, it must also fill in the applicable elements for the amalgamating member institution. If a member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than four fiscal years consisting of at least 12 months each (with the last fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 7 and 7.5 but still fill in any of elements 7.1 to 7.4 that apply to it. If a member institution acquires assets in the fiscal year ending in the year preceding the filing year as a result of a merger with or the acquisition of a regulated deposit-taking institution or as a result of the acquisition of the deposit-taking business of a regulated institution, and the value of those acquired assets on the date of their acquisition exceeds 15% of the value of the consolidated assets of the member institution immediately before that merger or acquisition, the member institution must include the value of those acquired assets in elements 7.1 to 7.3. | |||

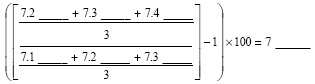

Formula: | |||

Complete the following: | |||

| Elements Use the instructions below to arrive at the elements of the formula. | |||

| Assets for Years 1 to 4: Assets for Year 1 Assets for Year 1 is the amount that the member institution entered as element 7.4 of the formula in the Reporting Form submitted by the member institution in the third filing year before the filing year in which this Reporting Form is being submitted. | |||

| Year 1: | 7.1 | ||

Assets for Year 2 Assets for Year 2 is the amount that the member institution entered as element 7.4 of the formula in the Reporting Form submitted by the member institution in the second filing year before the filing year in which this Reporting Form is being submitted. | |||

| Year 2: | 7.2 | ||

Assets for Year 3 Assets for Year 3 is the amount that the member institution entered as element 7.4 of the formula in the Reporting Form submitted by the member institution in the filing year before the filing year in which this Reporting Form is being submitted. | |||

| Year 3: | 7.3 | ||

Assets for Year 4 Refer to the Leverage Requirements Return (LRR), Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year, and to the Basel III Capital Adequacy Reporting – Credit, Market and Operational Risk (BCAR) form, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. Assets for Year 4 is the amount that the member institution determines by adding the following:

| |||

| 7.4.1 On-balance sheet assets Indicate the amount set out in the column “Accounting balance sheet value” for On-balance sheet assets - for purposes of the Leverage Ratio, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.2 Off-balance sheet Eligible servicer cash advance facilitiesIndicate the amount set out in the column “Notional Amount” for Eligible servicer cash advance facilities – 10% CCF, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.3 Other Off-balance sheet Securitization exposuresIndicate the amount set out in the column “Notional Amount” for Other off-balance sheet securitization exposures – 100% CCF, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.4 Off-balance sheet Direct credit substitutesIndicate the amount set out in the column “Notional Amount” for Direct credit substitutes – 100% CCF, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.5 Off-balance sheet Transaction-related contingent itemsIndicate the amount set out in the column “Notional Amount” for Transaction-related contingent items – 50% CCF, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.6 Off-balance sheet Short-term self-liquidating trade letters of creditIndicate the amount set out in the column “Notional Amount” for Short-term self-liquidating trade letters of credit – 20% CCF, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.7 Total derivative contract exposure (not covered)Indicate the amount set out in the column “Total Contracts” for “(A) Single derivative exposure not covered by an eligible netting contract, (i) Replacement cost”, as set out in Section 2 – Derivative Exposure Calculation of the LRR. 7.4.8 Total derivative contract exposure (covered)Indicate the amount set out in the column “Total Contracts” for “(B) Derivative exposure covered by an eligible netting contract, (i) Replacement cost”, as set out in Section 2 – Derivative Exposure Calculation of the LRR. 7.4.9 On-balance sheet DerivativesIndicate the amount set out in the column “Accounting balance sheet value” for Derivatives, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.10 On-balance sheet Grandfathered securitization exposuresIndicate the amount set out in the column “Accounting balance sheet value” for Grandfathered securitization exposures, as set out in Section 1 – Leverage Ratio Calculation of the LRR. 7.4.11 Net Common Equity Tier 1 Capital (CET1 after all deductions)Indicate the Net Common Equity Tier 1 Capital (CET1 after all deductions), as set out in Schedule 3 – Capital and TLAC Elements of the BCAR form. 7.4.12 Gross Common Equity Tier 1 CapitalIndicate the Gross Common Equity Tier 1 Capital, as set out in Schedule 3 – Capital and TLAC Elements of the BCAR form. 7.4.13 Total Deduction from Additional Tier 1 CapitalIndicate the Total Deduction from Additional Tier 1 Capital, as set out in Schedule 3 – Capital and TLAC Elements of the BCAR form. 7.4.14 Total Deduction from Tier 2 CapitalIndicate the Total Deduction from Tier 2 Capital, as set out in Schedule 3 – Capital and TLAC Elements of the BCAR form. 7.4.15 Eligible stage 1 and stage 2 allowanceIndicate the Eligible stage 1 and stage 2 allowance (re standardized approach), as set out in Schedule 3 – Capital and TLAC Elements of the BCAR form. 7.4.16 Excess allowanceIndicate the Excess allowance (re IRB approach), as set out in Schedule 3 – Capital and TLAC Elements of the BCAR form. 7.4.17 Direct credit substitutes – credit derivatives – Standardized ApproachIndicate the amount set out in the column “Notional Principal Amount (a)” for Direct credit substitutes – credit derivatives, as set out in Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures of the BCAR form. 7.4.18 Direct credit substitutes – credit derivatives – Foundation IRB approachIndicate the amount set out in the column “Notional Principal Amount (d)” for Direct credit substitutes – credit derivatives, as set out in Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures of the BCAR form. 7.4.19 Direct credit substitutes – credit derivatives – Advanced IRB approachIndicate the amount set out in the column “Notional Principal Amount (g)” for Direct credit substitutes – credit derivatives, as set out in Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures of the BCAR form. 7.4.20 Sale and repurchase agreements – Standardized approachIndicate the amount set out in the column “Notional Principal Amount (a)” for Sale & repurchase agreements, as set out in Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures of the BCAR form. 7.4.21 Sale and repurchase agreements – Foundation IRB approachIndicate the amount set out in the column “Notional Principal Amount (d)” for Sale & repurchase agreements, as set out in Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures of the BCAR form. 7.4.22 Sale and repurchase agreements – Advanced IRB approachIndicate the amount set out in the column “Notional Principal Amount (g)” for Sale & repurchase agreements, as set out in Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures of the BCAR form. 7.4.23 Stage 1 and Stage 2 allowance on balance sheet assetsIndicate the sum of the amounts set out for “Stage 1 and Stage 2 allowance (excluding securitization allowance) on balance sheet assets for capital purposes” and “Allowance on assets capitalized under the securitization framework not recognized for capital purposes”, as set out in Schedule 45 – Balance Sheet Coverage by Risk Type and Reconciliation to Consolidated Balance Sheet of the BCAR form. 7.4.24 “On-balance sheet” securitization exposuresIndicate the “On-balance sheet” securitization exposures recognized for capital ratio but not for consolidated balance sheet purposes, as set out in Schedule 45 – Balance Sheet Coverage by Risk Type and Reconciliation to Consolidated Balance Sheet of the BCAR form. 7.4.25 Adjustments – measurement basesIndicate the Adjustments to reflect differences in balance sheet exposure amounts resulting from measurement bases used for accounting purposes (fair values) as set out in Schedule 45 – Balance Sheet Coverage by Risk Type and Reconciliation to Consolidated Balance Sheet of the BCAR form. 7.4.26 Adjustments – recognition basesIndicate the Adjustments to reflect differences in balance sheet exposure amounts resulting from recognition bases used for accounting purposes (settlement / trade date), as set out in Schedule 45 – Balance Sheet Coverage by Risk Type and Reconciliation to Consolidated Balance Sheet of the BCAR form. | |||

| Year 4: | 7.4 | ||

| Indicate the number of fiscal years consisting of at least 12 months that the member institution has been operating as a member institution (if less than six fiscal years). | |||

| A member institution must report assets for the last four fiscal years. | |||

| If a member institution has been operating as a member institution for less than four fiscal years consisting of at least 12 months each, it must indicate “N/A” (“not applicable”) for the elements corresponding to the fiscal years for which it was not operating as a member institution. | |||

| 8 REAL ESTATE ASSET CONCENTRATION A member institution that is a domestic systemically important bank is not required to complete item 8 and will insert “N/A” as its score for element 8.5. It must complete element 8-1. |

|---|

| Threshold Formula: (Total Mortgage Loans) ÷ (Total Mortgage Loans + Total Non-Mortgage Loans + Total Securities + Total Acceptances) × 100 |

| Complete the following: (8.1 — — — —) ÷ (8.1 — — — — + 8.2 — — — — + 8.3 — — — — + 8.4 — — — —) × 100 = |

| Elements Use the instructions below to arrive at the elements of the threshold formula. Refer to the Mortgage Loans Report, the Non-Mortgage Loans Report and Section I – Assets of the Consolidated Monthly Balance Sheet, Reporting Manual, all completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. |

| 8.1 Total Mortgage Loans The total mortgage loans is the sum of the amounts set out in the column “Total” under “Total Mortgage Loans” and “Less allowance for expected credit losses” in Section I of the Mortgage Loans Report. |

| 8.2 Total Non-Mortgage Loans The total non-mortgage loans is the sum of the amounts set out for “Total” in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” in the Non-Mortgage Loans Report. |

| 8.3 Total Securities The total securities is the total of the amounts set out in the column “Total” for Securities set out in Section I — Assets of the Consolidated Monthly Balance Sheet. |

| 8.4 Total Acceptances The total acceptances is the total of the amounts set out in the column “Total” for “Customers liability under acceptances, less allowance for expected credit losses” in Section I — Assets of the Consolidated Monthly Balance Sheet. |

If the result of the threshold formula is less than 10%, score five for element 8.5 and do not complete the rest of section 8. If that result is greater than or equal to 10%, complete the rest of section 8. |

| Fill in Table 8 using the definitions and instructions below. Refer to Section III of the Mortgage Loans Report, Reporting Manual, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. A member institution may complete these calculations using the information reported in the Mortgage Loans Report filed at its year-end or, if not filed at its year-end, at the calendar quarter-end preceding that year-end. |

| Fill in Table 8 for each of the following types of outstanding mortgages. |

| Residential Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for “Total Residential” in the columns “Insured” and “Uninsured” under “Gross Mortgage Loans Outstanding” in Section III of the Mortgage Loans Report, before deducting any allowance for expected credit losses. |

| Land Development Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate by adding together

|

| Hotel and Motel Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for “Hotels/motels” in the columns “Insured” and “Uninsured” under “Gross Mortgage Loans Outstanding” in Section III of the Mortgage Loans Report, before deducting any allowance for expected credit losses. |

| Industrial Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for “Industrial buildings” in the columns “Insured” and “Uninsured” under “Gross Mortgage Loans Outstanding” in Section III of the Mortgage Loans Report, before deducting any allowance for expected credit losses. |

| Single Family Dwelling Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for “Single detached” and “Individual condominium units” in the columns “Insured” and “Uninsured” under “Gross Mortgage Loans Outstanding” in Section III of the Mortgage Loans Report, before deducting any allowance for expected credit losses. |

| Second or Subsequent Mortgage Loans Outstanding Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. The total mortgage loans of this type is the amount set out for “Second and subsequent mortgages outstanding” in the column “Amounts Outstanding” in the second table of the Memo Items to Section IV of the Mortgage Loans Report, before deducting any allowance for expected credit losses. |

| Real Estate Under Power of Sale or Foreclosed Properties Properties of this type, located in Canada, are to be classified in accordance with the Reporting Manual. Calculate by adding together

|

Table 8

| A | B | C | D | E |

|---|---|---|---|---|

| Type | Amount | Percentage of Total Mortgage Loans (Amount from Column B ÷ Total Mortgage LoansFootnote for *) x 100 | Range of Results | ScoreFootnote for ** |

| Residential Properties Mortgage Loans | < 50% = 0 ≥ 50% and < 75% = 3 ≥ 75% = 5 | |||

| Land Development Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Hotel and Motel Properties Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Industrial Properties Mortgage Loans | > 15% = 0 > 10% and ≤ 15% = 3 ≤ 10% = 5 | |||

| Single Family Dwelling Properties Mortgage Loans | < 35% = 0 ≥ 35% and < 50% = 3 ≥ 50% = 5 | |||

| Second or Subsequent Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Real Estate Under Power of Sale or Foreclosed Properties | > 8% = 0 > 5% and ≤ 8% = 3 ≤ 5% = 5 |

Return to footnote *“Total Mortgage Loans” used in the calculation in column C must correspond to the amount of the Total Mortgage Loans determined for element 8.1.

Return to footnote **Fill in the score in column E for a type of mortgage loan or property set out in column A that corresponds to the percentage set out in column C, in accordance with the appropriate range set out in column D.

| 8-1 ASSET ENCUMBRANCE MEASURE Only a member institution that is a domestic systemically important bank must complete item 8-1. All other member institutions are to insert “N/A” for item 8-1.3. | |||

|---|---|---|---|

| 8-1.1 Unencumbered Asset Concentration | |||

| Threshold Formula: (Total Liabilities – (Subordinated Debt + Covered Bonds Liabilities + Securitization Liabilities + Repos + Shorts)) ÷ (Total Assets – (Impairment + Total Pledged Assets)) × 100 | |||

| Complete the following: (8-1.1.1 — — — – (8-1.1.2 — — — + 8-1.1.3 — — — + 8-1.1.4 — — — + 8-1.1.5 — — — + 8-1.1.6 — — — )) ÷ (8-1.1.7 — — — – (8-1.1.8 — — — + 8-1.1.9 — — — )) × 100 = | |||

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the Consolidated Monthly Balance Sheet, the Return of Allowances for Expected Credit Losses and Section I of the Pledging and Repos Report, Reporting Manual, all completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. | |||

| 8-1.1.1 Total Liabilities The total liabilities is calculated by deducting from the amount set out in the column “Total” for Total Liabilities and Shareholders’ Equity the amounts included as shareholders’ equity in Section II – Liabilities of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.2 Subordinated Debt The total subordinated debt is the amount set out in the column “Total” for Subordinated Debt in Section II – Liabilities of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.3 Covered Bonds Liabilities The covered bonds liabilities is the total of the amounts set out in the column “Total” for Selected information on covered bonds liabilities in Section II – Memo Items of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.4 Securitization Liabilities The securitization liabilities is the total of the amounts set out in the column “Total” for Securitization notes payable (institution’s own assets) and Securitization notes payable (third party assets) as set out for the Mortgages and Loans Payable in Section II – Memo Items of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.5 Repos The obligations related to assets sold under repurchase agreements is the amount set out in the column “Total” for Obligations related to assets sold under repurchase agreements in Section II – Liabilities of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.6 Shorts The obligations related to borrowed securities is the amount set out in the column “Total” for Obligations related to borrowed securities in Section II – Liabilities of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.7 Total Assets The total assets is the amount set out in the column “Total” for Total assets in Section I – Assets of the Consolidated Monthly Balance Sheet. | |||

| 8-1.1.8 Impairment Impairment is the amount set out for “Total” in the column “Recorded Investment Total” under “Stage III”, less the aggregate of the amounts set out for “Total” in the columns “Expected Credit Losses” under “Stage I”, “Stage II” and “Stage III”, in the Return of Allowances for Expected Credit Losses. | |||

| 8-1.1.9 Total Pledged Assets The total pledged assets is the total of the amounts set out in the column “OUTSTANDING END OF PERIOD – CONSOLIDATED ENTITY” for TOTAL and REPURCHASE AGREEMENTS (REPOS) of SECTION I – PLEDGING AND REPURCHASE AGREEMENTS of the Pledging and Repos Report. | |||

If the result of the threshold formula is equal to or less than 100%, score five for element 8-1.3 and do not complete the rest of item 8-1. If the result is greater than 100%, complete the rest of item 8-1. | |||

| 8-1.2 Pledged Asset Ratio | |||

| Formula: (Total Pledged Assets) ÷ (Total Assets) × 100 | |||

| Complete the following: (8-1.2.1 — — — —) ÷ (8-1.2.2 — — — —) × 100 = 8-1.2 | |||

| 8-1.2.1 Total Pledged Assets Indicate the total pledged assets as determined for element 8-1.1.9. | |||

| 8-1.2.2 Total Assets Indicate the total assets as determined for element 8-1.1.7. |

| 9 AGGREGATE COMMERCIAL LOAN CONCENTRATION RATIO (%) |

|---|

If the result of the threshold formula in section 8 is greater than 90%, indicate a score of five for element 9.4 and do not complete section 9. If the result of the threshold formula in section 8 is equal to or less than 90%, or the member institution is a domestic systemically important bank, complete section 9. |

| Formula: (Aggregate Commercial Loan Concentration) ÷ (Total Capital) × 100 |

| Complete the following: (9.1 — — — —) ÷ (9.2 — — — —) × 100 = 9 |

| Elements Refer to the Non-Mortgage Loans Report, Reporting Manual, completed in accordance with that Manual. Use the instructions below to arrive at the elements of the formula. A member institution may complete these calculations using the information reported in the Non-Mortgage Loans Report filed at its year-end or, if not filed at its year-end, at the calendar quarter-end preceding that year-end. |

| 9.1 Aggregate Commercial Loan Concentration The aggregate commercial loan concentration is the total of column B in Table 9, expressed in thousands of dollars. |

| 9.2 Total Capital The total capital as determined for element 6.3, expressed in thousands of dollars. |

| Fill in Table 9 following the instructions and using the definitions below. |

| Loans Loans are as described in the Non-Mortgage Loan Report |

| Person Means a natural person or an entity. |

| Entity Has the same meaning as in section 2 of the Bank Act. |

| Industry Sectors For the purpose of completing Table 9, commercial loans shall be grouped according to the classifications used for completing the Non-Mortgage Loan Report and using the 12 industry sectors in the list below. |

Industry Sector List

Calculate the commercial loans for each of the industry sectors in accordance with the following list and insert each of the totals on the appropriate line in Column A in Table 9. Refer to the Non-Mortgage Loans Report, Reporting Manual, completed in accordance with that Manual. |

| Agriculture Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount set out in the column “TC” under “Allowance for Expected Credit Losses”, all as set out for “Agriculture” in the Non-Mortgage Loans Report. |

| Fishing and Trapping Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for Expected Credit Losses”, all as set out for “Fishing and Trapping” in the Non-Mortgage Loans Report. |

| Logging and Forestry Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Logging and Forestry” in the Non-Mortgage Loans Report. |

| Mining, Quarrying and Oil Wells Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Mining, Quarrying and Oil Wells” in the Non-Mortgage Loans Report. |

| Manufacturing Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Manufacturing” in the Non-Mortgage Loans Report. |

| Construction/Real Estate Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Construction/Real Estate” in the Non-Mortgage Loans Report. |

| Transportation, Communication and Other Utilities Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Transportation, Communication and Other Utilities” in the Non-Mortgage Loans Report. |

| Wholesale Trade Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Wholesale Trade” in the Non-Mortgage Loans Report. |

| Retail Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Retail” in the Non-Mortgage Loans Report. |

| Service Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount in the column “TC” under “Allowance for expected credit losses”, all as set out for “Service” in the Non-Mortgage Loans Report. |

| Multiproduct Conglomerates Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount set out in the column “TC” under “Allowance for expected credit losses”, all as set out for “Multiproduct Conglomerates” in the Non-Mortgage Loans Report. |

| Others (Private Not for Profit Institutions, Religious, Health and Educational Institutions) Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “TC” under “Resident Loan Balances” and “Non-Resident Loan Balances” and subtracting the amount set out in the column “TC” under “Allowance for expected credit losses”, all as set out for “Others (Private Not for Profit Institutions, Religious, Health and Educational Institutions)” in the Non-Mortgage Loans Report. |

Table 9

| Instructions | ||

|---|---|---|

Insert 10% of total capital as determined for element 6.3: In column A below, report the amount calculated in accordance with the instructions for each industry sector. In column B below, for each industry sector that has an amount reported in column A that

| ||

| Industry Sector | Column A | Column B (Column A minus element 9.3; if negative, report “0”) |

| Agriculture | ||

| Fishing & Trapping | ||

| Logging & Forestry | ||

| Mining, Quarrying & Oil Wells | ||

| Manufacturing | ||

| Construction / Real Estate | ||

| Transportation, Communication & Other Utilities | ||

| Wholesale Trade | ||

| Retail | ||

| Service | ||

| Multiproduct Conglomerates | ||

| Others (Private Not for Profit Institutions, Religious, Health & Educational Institutions | ||

| Total of Column B | ||

| Carry total of column B forward to element 9.1 | ||

The information provided in this Reporting Form is based on:

audited financial statements

audited financial statements

unaudited financial statements

unaudited financial statements

This Reporting Form was prepared by

| Name and Title: |  |

| Business mailing address: |  |

| Business telephone number: |  |

| Business email address: |  |

| Note: The above information may be used by CDIC to contact the member institution to discuss this Reporting Form. | |

Certification

The Chief Financial Officer, or other authorized officer, (Name of Officer),

by submitting this Reporting Form to the Canada Deposit Insurance Corporation, certifies that the information provided in this Reporting Form is correct and that it has been completed in accordance with the Canada Deposit Insurance Corporation Differential Premiums By-law.

Date Name of Member Institution

Name of Member Institution

- SOR/2000-38, ss. 3, 4(E), 5 to 9

- SOR/2001-24, ss. 1, 2

- SOR/2002-126, ss. 9 to 13

- SOR/2005-48, ss. 10 to 18

- SOR/2006-47, ss. 6, 7, 8(E), 9

- SOR/2007-26, ss. 3, 4

- SOR/2009-12, ss. 3 to 11

- SOR/2010-4, ss. 6 to 10

- SOR/2010-307, ss. 7, 8(E), 9 to 11

- SOR/2011-312, ss. 1 to 4

- SOR/2013-6, ss. 1 to 4

- SOR/2014-29, ss. 2 to 6, 8

- SOR/2015-75, ss. 14 to 24, 26(F)

- SOR/2016-11, ss. 2, 3, 4(E), 5 to 7

- SOR/2017-22, ss. 5 to 9

- SOR/2018-8, ss. 5 to 8

- SOR/2019-43, s. 11

- SOR/2019-43, s. 12

- SOR/2019-43, s. 13

- SOR/2019-43, s. 14

- SOR/2019-43, s. 15

- SOR/2019-43, s. 16

- SOR/2019-43, s. 17

- SOR/2020-21, s. 5

- SOR/2020-21, s. 6

- SOR/2020-21, s. 7

- SOR/2020-21, s. 8

- SOR/2020-21, s. 9

- SOR/2020-21, s. 10

- SOR/2020-21, s. 11

- SOR/2020-21, s. 12

- SOR/2020-21, s. 13

- SOR/2020-21, s. 14

- SOR/2020-21, s. 15

- SOR/2021-28, s. 2

- SOR/2021-28, s. 3

- SOR/2022-54, s. 1

- Date modified: