Canada Deposit Insurance Corporation Differential Premiums By-law

SOR/99-120

CANADA DEPOSIT INSURANCE CORPORATION ACT

Registration 1999-03-10

Canada Deposit Insurance Corporation Differential Premiums By-law

The Board of Directors of the Canada Deposit Insurance Corporation, pursuant to paragraph 11(2)(g)Footnote a and section 21Footnote b of the Canada Deposit Insurance Corporation Act, hereby makes the annexed Canada Deposit Insurance Corporation Differential Premiums By-law.

Return to footnote aR.S., c. 18 (3rd Supp.), s. 51

Return to footnote bS.C. 1996, c. 6, s. 27

March 3, 1999

The Minister of Finance, pursuant to subsection 21(3)Footnote a of the Canada Deposit Insurance Corporation Act, hereby approves the annexed Canada Deposit Insurance Corporation Differential Premiums By-law made by the Board of Directors of the Canada Deposit Insurance Corporation.

Ottawa, March 4, 1999

Interpretation

1 (1) The definitions in this subsection apply in this By-law.

- Act

Act means the Canada Deposit Insurance Corporation Act. (Loi)

- CDIC standards

CDIC standards[Repealed, SOR/2005-116, s. 1]

- examiner

examiner means

(a) in respect of a federal member institution, the Superintendent; and

(b) in respect of a provincial member institution

(i) the Corporation or a person designated under paragraph 28(a) of the Act, or

(ii) the government of a province or the agent of the government of a province with whom the Corporation has entered into an agreement under section 38 of the Act. (inspecteur)

- filing year

filing year means the calendar year in which a member institution is required to submit the documents referred to in section 15 for the purpose of determining the institution’s annual premium for the premium year beginning in that calendar year. (année de déclaration)

- Guidelines for Banks

Guidelines for Banks means the Guidelines for Banks issued by the Superintendent under the Bank Act. (Lignes directrices à l’intention des banques)

- Guidelines for Trust and Loan Companies

Guidelines for Trust and Loan Companies means the Guidelines for Trust and Loan Companies issued by the Superintendent under the Trust and Loan Companies Act. (Lignes directrices à l’intention des sociétés de fiducie et de prêt)

- new member institution

new member institution[Repealed, SOR/2002-126, s. 1]

- regulator

regulator means

(a) in respect of a federal member institution, the Superintendent; and

(b) in respect of a provincial member institution, the authority whose mandate in respect of the institution under the provincial law governing the institution is comparable to that of the Superintendent in respect of federal member institutions. (organisme de réglementation)

- Reporting Form

Reporting Form means the reporting form set out in Part 2 of Schedule 2. (formulaire de déclaration)

- Reporting Manual

Reporting Manual means the Manual of Reporting Forms and Instructions for Deposit-Taking Institutions issued by the Superintendent under the Bank Act and the Trust and Loan Companies Act. (Recueil des formulaires et des instructions)

- subsidiary

subsidiary has the same meaning as in section 2 of the Bank Act. (filiale)

(2) Unless otherwise provided in this By-law, terms and expressions used in this By-law have the same meaning as in the Guidelines for Banks, the Guidelines for Trust and Loan Companies or the Reporting Manual.

(3) For the purpose of determining the annual premium of a member institution for a premium year, a reference in this By-law to the Guidelines for Banks, the Guidelines for Trust and Loan Companies or the Reporting Manual is a reference to that publication as amended up to and including October 31 preceding the premium year.

(4) For the purposes of sections 15 and 16 and Schedule 2, a reference, in respect of an amalgamating member institution, to the fiscal year ending in the year preceding the filing year means a reference to the period covered by its audited financial statements prepared as of the day preceding the date of its amalgamation where

(a) that institution does not have a fiscal year ending in the year preceding the filing year; and

(b) that amalgamation occurred after April 30 of the year preceding the filing year and on or before April 30 of the filing year.

(5) A reference in Schedule 2 or Schedule 3 to a multiple or ratio authorized or required in respect of a member institution by its regulator means a multiple or ratio authorized or required by that regulator in the course of the regulator’s duties.

(6) [Repealed, SOR/2006-47, s. 1]

- SOR/2001-299, s. 37

- SOR/2002-126, s. 1

- SOR/2005-48, s. 1

- SOR/2005-116, s. 1

- SOR/2006-47, s. 1

- SOR/2009-12, s. 1

Application

2 (1) Section 3 applies, for the purpose of subsection 23(1) of the Act, in respect of the calculation of the premium payable by a member institution referred to in that subsection.

(2) Sections 4 to 30 apply in respect of the calculation of the annual premium payable by a member institution for a full premium year.

- SOR/2005-48, s. 2(E)

Annual Premium

3 For the purpose of paragraph 23(1)(a) of the Act, the annual premium for a member institution referred to in subsection 23(1) is equal to the greater of

(a) $5,000, and

(b) the result determined in accordance with the formula

A × B × C

where

- A

- is one third of one per cent, or any smaller proportion of one per cent that is fixed by the Governor in Council under subparagraph 23(1)(b)(ii) of the Act,

- B

- is an amount equal to the sum of the deposits referred to in paragraph 23(1)(b)(ii) of the Act, and

- C

- is the percentage set out in column 3 of Schedule 1 for premium category 1.

4 (1) For the purpose of paragraph 21(1)(a) of the Act, the annual premium for each member institution is equal to the greater of

(a) $5,000, and

(b) subject to subsection (2), the result determined in accordance with the formula

A × B × C

where

- A

- is one third of one per cent, or any smaller proportion of one per cent that is fixed by the Governor in Council under paragraph 21(4)(b) of the Act,

- B

- is an amount equal to the sum of the deposits referred to in paragraph 21(4)(b) of the Act, and

- C

- is the percentage set out in column 3 of an item of Schedule 1 that corresponds to the premium category of the member institution set out in column 1 of that item.

(2) If a member institution is reclassified under section 6, the following formula shall be used to determine the result for the purposes of paragraph (1)(b):

(D × (E ÷ 365)) + (F × (G ÷ 365))

where

- D

- is the amount that would be the result under paragraph (1)(b) if C in that paragraph represented the percentage set out in column 3 of item 4 of Schedule 1;

- E

- is the number of days during the period beginning on May 1 of the filing year and ending on the day that the Corporation receives the declaration referred to in paragraph 7(1)(b) or the documents required by subsection 15(1) or section 16 from the member institution;

- F

- is the amount that would be the result under paragraph (1)(b) if C in that paragraph were the percentage set out in column 3 of an item of Schedule 1 for the premium category, set out in column 1 of that item, in which the member institution is reclassified; and

- G

- is the number of days during the period beginning on the day after the day that the Corporation receives the declaration referred to in paragraph 7(1)(b) or the documents required by subsection 15(1) or section 16 from the member institution and ending on April 30 of the year following the filing year referred to in E.

- SOR/2000-38, s. 1

- SOR/2002-126, s. 2

Determination of Premium Category

Classification

5 The Corporation shall, before July 15 of each premium year, classify

(a) every member institution, that is a subsidiary of one or more other member institutions, in the same premium category as the one other member institution that is not itself a subsidiary of a member institution; and

(b) subject to section 12, every other member institution in accordance with section 7 or 8, as the case may be.

6 (1) The Corporation shall review the classification of every member institution that has been classified in premium category 4 in accordance with section 12 if the institution submits to the Corporation on or before April 30 of the year following the filing year

(a) if the institution is an institution described in paragraph 12(1)(a), audited financial statements and a revised Reporting Form or a declaration that the audited financial statements confirm the information set out in the Reporting Form and no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs 15(1)(c) to (e) as previously submitted; and

(b) if the institution is an institution described in paragraph 12(1)(b), the declaration referred to in paragraph 7(1)(b) or the documents required by paragraphs 15(1)(a) to (e) or section 16.

(2) The Corporation shall reclassify in accordance with section 7 or 8, as the case may be, a member institution referred to in subsection (1) if, based on the documents referred to in that subsection, such a reclassification is warranted.

- SOR/2000-38, s. 2(F)

- SOR/2002-126, s. 3

New Member Institutions

7 (1) A member institution shall be classified in premium category 1 as set out in column 1 of Schedule 1, if

(a) the member institution has been operating as a member institution for less than two fiscal years consisting of at least 12 months each, determined as of the end of the fiscal year ending in the year preceding the filing year; and

(b) not later than April 30 of the filing year, the member institution provides the Corporation with a declaration confirming that the member institution meets the condition referred to in paragraph (a).

(2) Subsection (1) does not apply to a member institution that

(a) is a subsidiary of a member institution that has been operating for at least two fiscal years consisting of at least 12 months each, determined as of the end of the fiscal year ending in the year preceding the filing year; or

(b) has a subsidiary that is a member institution that has been operating for at least two fiscal years consisting of at least 12 months each, determined as of the end of the subsidiary’s fiscal year ending in the year preceding the filing year.

(2.1) A member institution that is a bridge institution shall be classified in premium category 1 as set out in column 1 of Schedule 1.

(3) For the purpose of this section, if a member institution is formed by an amalgamation involving one or more member institutions, the amalgamated member institution shall be considered to have started operating on the same day as the amalgamating member institution that has been operating for the longest period of time.

- SOR/2002-126, s. 4

- SOR/2010-4, s. 1

Evaluation

8 A member institution, other than one classified in accordance with section 7, shall be classified in the premium category set out in column 1 of an item of Schedule 1 that corresponds to the total score for the institution determined in accordance with section 9, 10 or 11, as the case may be, and set out in column 2 of that item.

- SOR/2002-126, s. 4

9 In order to determine the total score of a member institution, other than a member institution referred to in section 10 or subsection 11(1), the Corporation shall add together the institution’s scores for quantitative factors assigned under sections 20 to 27 and qualitative factors and criteria assigned under sections 28 and 30.

- SOR/2006-47, s. 2

10 Subject to subsections 11(4) and 12(2), if a member institution that started operating as a member institution after April 30 of the year preceding the filing year would be classified in premium category 1 in accordance with section 7 if it did not have any subsidiaries of the type described in paragraph 7(2)(b), the Corporation shall assign to that institution the highest of the total scores assigned to each of its subsidiaries that

(a) on the day preceding the day that the institution started to operate as a member institution was not a subsidiary of another member institution; and

(b) is not a subsidiary of another member institution.

- SOR/2002-126, s. 5

11 (1) In order to determine the total score of a member institution formed by an amalgamation involving one or more member institutions that occurred after April 30 of the year preceding the filing year and on or before April 30 of the filing year, the Corporation shall add together the score assigned to the amalgamated member institution in respect of quantitative factors under subsection (2) and the score assigned to that institution in respect of qualitative factors and criteria under subsection (3).

(2) The following score shall be assigned to an amalgamated member institution referred to in subsection (1) in respect of quantitative factors:

(a) where the amalgamated member institution has a fiscal year ending in the year preceding the filing year, the sum of the scores assigned to that institution under sections 20 to 27; and

(b) where the amalgamated member institution does not have a fiscal year ending in the year preceding the filing year,

(i) if only one of the amalgamating institutions is a member institution, the sum of the scores assigned to that member institution under sections 20 to 27, and

(ii) if two or more of the amalgamating institutions are member institutions, the highest of the sums of the scores assigned to each of those amalgamating member institutions under sections 20 to 27.

(3) The score assigned to an amalgamated member institution referred to in subsection (1) in respect of qualitative factors and criteria shall consist of the sum of

(a) the score assigned to it under section 28 or, if no score can be assigned to it under that section, the score that would have been assigned under section 28 to the amalgamating member institution whose score in respect of quantitative factors was used to determine the score of the amalgamated member institution in respect of those factors for the purpose of subsection (2), if that section applied to that amalgamating member institution, and

(b) [Repealed, SOR/2006-47, s. 3]

(c) the score assigned to the amalgamated member institution under section 30.

(4) Where section 10 and this section both apply in respect of a member institution, this section shall prevail.

- SOR/2006-47, s. 3

12 (1) Notwithstanding sections 8, 9 and 11, a member institution shall be classified in premium category 4 as set out in column 1 of Schedule 1 if it

(a) has submitted a Reporting Form in accordance with paragraph 15(4)(a) or 16(2)(a), as the case may be, but has not, before July 1 of the filing year, submitted audited financial statements and a revised Reporting Form or a declaration that the audited financial statements confirm the information set out in the Reporting Form and no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs 15(1)(c) to (e), as previously submitted; or

(b) has not, by April 30 of the filing year, submitted the declaration referred to in paragraph 7(1)(b) or the documents required by paragraphs 15(1)(a) to (e) or section 16.

(2) Subsection (1) applies in respect of a member institution where its subsidiaries are required to comply with the requirements of section 15 and one or more of those subsidiaries fails to do so.

(3) Subsection (1) does not apply to a member institution referred to in subsection 7(2.1).

- SOR/2002-126, s. 6

- SOR/2010-4, s. 2

13 [Repealed, SOR/2002-126, s. 7]

Notification

14 (1) The Corporation shall, not later than July 15 of each premium year, notify every member institution of the premium category in which it has been classified under this By-law for that premium year.

(2) Where the Corporation reviews the classification of a member institution based on information in respect of the institution that has come to its attention, including new or supplementary information submitted by the institution and, as a result of that review, classifies the institution in a different premium category, the Corporation shall as soon as practicable notify the institution of that change.

Filing of Quantitative Information

15 (1) Subject to section 17, every member institution shall submit to the Corporation, not later than April 30 of every year,

(a) the Reporting Form, completed in accordance with the instructions set out in the Form;

(b) a list of its subsidiaries that are member institutions;

(c) in the case of a federal member institution, the following returns unless they have been previously submitted to the Corporation, namely,

(i) the Capital Adequacy Returns, collectively entitled “Capital Adequacy Report”, set out in the Guidelines for Banks, Volume 1, or the Guidelines for Trust and Loan Companies, Volume 1, as the case may be, completed in accordance with the applicable Guidelines, as of the end of its 2006 and 2007 fiscal years, that is, the end of the fiscal year ending in 2006 and the end of the fiscal year ending in 2007, and

(ii) the Basel II Capital Adequacy Reporting – Credit, Market and Operational Risk return, set out on the website of the Office of the Superintendent of Financial Institutions, completed in accordance with the Guidelines for Banks or the Guidelines for Trust and Loan Companies, as applicable, as of the end of each of its two preceding fiscal years, that is, as of the end of the fiscal year ending in the year preceding the filing year and the end of the fiscal year ending in the second year preceding the filing year;

(d) in the case of a provincial member institution, the following returns unless they have been previously submitted to the Corporation, namely,

(i) the Capital Adequacy Returns, collectively entitled “Capital Adequacy Report”, set out in the Guidelines for Trust and Loan Companies, Volume 1, completed in accordance with the Guidelines, as of the end of its 2006 and 2007 fiscal years, that is, the end of the fiscal year ending in 2006 and the end of the fiscal year ending in 2007, and

(ii) the Basel II Capital Adequacy Reporting – Credit, Market and Operational Risk return, set out on the website of the Office of the Superintendent of Financial Institutions, completed in accordance with the Guidelines for Banks or the Guidelines for Trust and Loan Companies, as applicable, as of the end of each of its two preceding fiscal years, that is, as of the end of the fiscal year ending in the year preceding the filing year and the end of the fiscal year ending in the second year preceding the filing year;

(e) the following documents set out in the Reporting Manual, namely,

(i) the Consolidated Statement of Income, Retained Earnings and AOCI at the “Income Statement” tab, completed in accordance with that Manual, for its preceding fiscal year,

(ii) the Return of Impaired Assets at the “Impaired Assets” tab, completed in accordance with that Manual as of the end of its preceding fiscal year,

(iii) [Repealed, SOR/2007-26, s. 1]

(iv) the Consolidated Monthly Balance Sheet at the “Balance Sheet” tab, completed in accordance with that Manual as of the end of its preceding fiscal year,

(v) Section III of the Mortgage Loans Report at the "Mortgage Loans" tab, completed in accordance with that Manual as of the end of its preceding fiscal year,

(vi) the Non-Mortgage Loan Report at the "Non-Mortgage Loans" tab, completed in accordance with that Manual as of the end of its preceding fiscal year; and

(f) the audited financial statements on which the information provided in the Reporting Form and the returns and documents referred to in paragraphs (c) to (e) are based, unless those financial statements have been submitted to the Corporation under the Canada Deposit Insurance Corporation Deposit Insurance Policy By-law.

(2) The information provided by a member institution on the Reporting Form and in the returns and documents referred to in paragraphs (1)(c) to (e) must

(a) be based on audited financial statements prepared as of the end of the applicable fiscal year;

(b) be consistent with the financial statements referred to in paragraph (a); and

(c) be based on consolidated financial information as of the end of the applicable fiscal year.

(3) Unless otherwise provided in this By-law, financial information that is provided under this By-law shall be prepared in accordance with generally accepted accounting principles, the primary source of which is the Handbook of the Canadian Institute of Chartered Accountants.

(4) If the audited financial statements referred to in paragraph (1)(f) have not been issued by April 30 of the filing year, the member institution shall

(a) complete the Reporting Form and the returns and documents referred to in paragraphs (1)(c) to (e) based on its unaudited financial statements and submit them to the Corporation within the time required by subsection (1); and

(b) not later than July first of the filing year, submit to the Corporation its audited financial statements and

(i) provide the Corporation with a declaration that the audited financial statements confirm the information that was previously provided and that no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs (1)(c) to (e) as previously submitted, or

(ii) submit a revised Reporting Form and the returns and documents referred to in paragraphs (1)(c) to (e) in revised form if they have been revised to conform with the audited financial statements.

- SOR/2005-48, s. 3

- SOR/2007-26, s. 1

- SOR/2009-12, s. 2

- SOR/2010-4, s. 3

16 (1) Notwithstanding section 15 and subject to section 18, a member institution that has been formed by an amalgamation involving one or more member institutions that occurred after April 30 of the year preceding the filing year and on or before April 30 of the filing year and that does not have a fiscal year ending in the year preceding the filing year shall submit to the Corporation not later than April 30 of the filing year a list of its subsidiaries that are member institutions and

(a) for each amalgamating member institution that has a fiscal year ending in the year preceding the filing year, the documents referred to in subsection 15(1) other than the list referred to in paragraph 15(1)(b); and

(b) for each amalgamating member institution that does not have a fiscal year ending in the year preceding the filing year

(i) its audited financial statements prepared as of the day preceding the date of amalgamation, and

(ii) the Reporting Form and the returns referred to in paragraph 15(1)(c) or (d) and the documents referred to in paragraph 15(1)(e), which returns and documents must consist of information that is based on and consistent with the audited financial statements referred to in subparagraph (i), and must be based on consolidated financial information as of the day preceding the date of amalgamation.

(2) If an amalgamating member institution referred to in subsection (1) has not issued audited financial statements by April 30 of the filing year, the amalgamated member institution shall submit to the Corporation for that amalgamating member institution

(a) within the time required by subsection (1), the Reporting Form and the returns and documents required to be submitted by that subsection, which returns and documents must consist of information that is based on that institution’s unaudited financial statements; and

(b) not later than July first of the filing year, that institution’s audited financial statements and

(i) provide the Corporation with a declaration that the audited financial statements confirm the information that was previously provided and that no modifications are required to be made to the Reporting Form or to the returns and documents referred to in paragraphs 15(1)(c) to (e) as previously submitted, or

(ii) submit a revised Reporting Form and the returns and documents referred to in paragraphs 15(1)(c) to (e) in revised form if they have been revised to conform with the audited financial statements.

17 Section 15 does not apply to a member institution

(a) that is a member institution classified in accordance with subsection 7(1) or (2.1);

(b) that is a subsidiary of another member institution, unless it is a subsidiary described in paragraphs 10(a) and (b) and a total score is assigned to that other member institution in accordance with section 10; or

(c) to which a total score is assigned in accordance with section 10.

- SOR/2005-48, s. 4

- SOR/2010-4, s. 4

18 Section 16 does not apply to a member institution that

(a) is a member institution classified in accordance with subsection 7(1) or (2.1); or

(b) is a subsidiary of another member institution.

- SOR/2005-48, s. 5

- SOR/2010-4, s. 5

Records

19 (1) Every member institution shall prepare and maintain records that accurately and fully describe and disclose the information on which the information provided in the Reporting Form is based.

(2) Every member institution shall retain the records referred to in subsection (1) in Canada for a period of at least six years after they are prepared.

(3) Where a member institution amalgamates with, or acquires all or substantially all of the assets of, one or more other member institutions, the institution that results from the amalgamation or acquisition shall retain the records of those other member institutions for a period of at least six years following the date of the amalgamation or acquisition.

Quantitative Factors

20 (1) The Corporation shall review the Reporting Form and other documents submitted by a member institution under section 15 or 16, and shall, where the Reporting Form and other documents have not been completed in accordance with this By-law, make whatever adjustments are necessary.

(2) The Corporation shall, in accordance with sections 21 to 27, assign to each member institution the scores that correspond to the results set out in the Reporting Form, reviewed and, if applicable, adjusted in accordance with subsection (1).

21 The Corporation shall compare the results obtained for a member institution in respect of its capital adequacy under elements 1.1, 1.2 and 1.3 of item 1 of the Reporting Form with the range of results set out in columns 1 to 3 of Part 1 of Schedule 3 and shall assign a score to the member institution in respect of its capital adequacy as follows:

(a) if all the results for the institution correspond to the range of results set out in each of columns 1 to 3 of the same item of Part 1 of Schedule 3, the institution shall be assigned the score set out in column 4 of that item; and

(b) if the results for the institution do not all correspond to the range of results set out in each of columns 1 to 3 of the same item of Part 1 of Schedule 3, the institution shall be assigned the lowest of the scores set out in column 4 of the items containing results that correspond to each of the institution’s results.

22 The Corporation shall compare the result obtained for a member institution in respect of the factor in item 2 of the Reporting Form with the range of results set out for that factor in column 2 of item 4 of Part 2 of Schedule 3 and shall assign to the institution the score set out in column 3 of that item that corresponds to that institution’s result.

23 (1) Subject to section 27, the Corporation shall compare the results obtained for a member institution in respect of each of the factors in items 3 and 4 of the Reporting Form with the range of results set out for those factors in items 5 and 6, respectively, in column 2 of Part 2 of Schedule 3 and shall assign to the institution the scores set out in column 3 of each of those items that correspond to that institution’s results, respectively.

(2) For the purpose of subsection (1), if an amalgamated member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than three fiscal years consisting of at least 12 months each, the scores assigned to the amalgamated member institution shall be based on the results obtained for the institution using the financial information

(a) of the amalgamated member institution for the fiscal years during which it has been operating as a member institution; and

(b) of the amalgamating member institution for the other applicable fiscal years.

- SOR/2005-48, s. 6(E)

24 The Corporation shall compare the results obtained for a member institution in respect of each of the factors in items 5 and 6 of the Reporting Form with the range of results set out for those factors in column 2 of items 7 and 8, respectively, of Part 2 of Schedule 3 and shall assign to the institution the scores set out in column 3 of each of those items that correspond to that institution’s results, respectively.

- SOR/2005-48, s. 7

24.1 (1) Subject to section 27, the Corporation shall compare the result obtained for a member institution in respect of the factor in item 7 of the Reporting Form with the range of results set out for that factor in column 2 of item 9 of Part 2 of Schedule 3 and shall assign to the institution the score set out in column 3 of that item that corresponds to that institution’s result.

(2) For the purpose of subsection (1), if an amalgamated member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than four fiscal years consisting of at least 12 months each, the score assigned to the amalgamated member institution shall be based on the result obtained for the institution using the financial information

(a) of the amalgamated member institution for the fiscal years during which it has been operating as a member institution; and

(b) of the amalgamating member institution for the other applicable fiscal years.

- SOR/2005-48, s. 7

25 The Corporation shall assign the score to a member institution for the factor in item 8 of the Reporting Form as follows:

(a) if the result of the threshold formula in item 8 of the Reporting Form is less than 10 per cent, the score to be assigned is 5; and

(b) if the result of the threshold formula in item 8 of the Reporting Form is equal to or greater than 10 per cent, the score to be assigned is the lowest of the scores set out for a type of mortgage loan in column “E” of an item of Table 8 to item 8 of the Reporting Form.

26 The Corporation shall assign the score to a member institution for the factor in item 9 of the Reporting Form as follows:

(a) if the result of the threshold formula in item 8 of the Reporting Form is greater than 90 per cent, the score to be assigned is 5; and

(b) if the result of the threshold formula in item 8 of the Reporting Form is equal to or less than 90 per cent, the Corporation shall compare the results obtained for the member institution in respect of that factor with the range of results set out for that factor in column 2 of item 10 of Part 2 of Schedule 3 and shall assign to the institution the score set out in column 3 of that item that correspond to that institution’s results, respectively.

27 (1) If a member institution has been operating as a member institution for less than five fiscal years consisting of at least 12 months each, the combined score in respect of the factors in items 3, 4 and 7 of the Reporting Form shall be determined in accordance with the formula

(A ÷ 45) × 15

where

- A

- is the sum of the scores assigned to the member institution under sections 21, 22, 24, 25 and 26.

(2) If an amalgamated member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than three fiscal years consisting of a least 12 months each, the combined score in respect of the factors in items 3, 4 and 7 of the Reporting Form shall be determined in accordance with subsection (1).

(3) If a member institution has been operating as a member institution for five fiscal years consisting of at least 12 months each, the score in respect of the factors in item 7 of the Reporting Form shall be determined in accordance with the formula

(A ÷ 55) × 5

where

- A

- is the sum of the scores assigned to the member institution under sections 21, 22, 23, 24, 25 and 26.

(4) If an amalgamated member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for three fiscal years consisting of at least 12 months each, the score in respect of the factors in item 7 of the Reporting form shall be determined in accordance with subsection (3).

- SOR/2002-126, s. 8

- SOR/2005-48, s. 8

Qualitative Factors and Criteria

Examiner’s Rating

28 (1) For the purposes of this section, examiner’s rating in respect of a member institution means the rating on a scale of one to five that is assigned to the institution by the examiner in the course of carrying out the examiner’s duties.

(2) Subject to subsection (3), the Corporation shall assign to each member institution the score set out in column 2 of an item of Schedule 4 that corresponds to the examiner’s rating for the institution set out in column 1 of that item, which rating is the most recent of the following ratings that is available to the Corporation, namely,

(a) the examiner’s rating as of April 30 of the filing year;

(b) the most recent examiner’s rating assigned to the institution during the period beginning on May 1 of the year preceding the filing year and ending on April 29 of the filing year; and

(c) the examiner’s rating used for the evaluation of the member institution for the preceding premium year.

(3) If none of the examiner’s ratings referred to in subsection (2) is available to the Corporation for the member institution, the score to be assigned to the institution for the qualitative factor under this section shall be the result determined in accordance with the formula

(A ÷ 65) × 35

where

- A

- is the sum of the scores assigned to the member institution under sections 21 to 27 and 30.

- SOR/2004-57, s. 1

- SOR/2006-47, s. 4

- SOR/2007-26, s. 2(E)

29 [Repealed, SOR/2006-47, s. 5]

29.1 [Repealed, SOR/2005-116, s. 2]

Other Information

30 (1) In this section, supervisory authority means an examiner, a regulator, any foreign authority that monitors the activities of financial institutions and a securities commission, a stock exchange or any other similar authority.

(2) The Corporation shall, based on information about the safety, soundness, financial condition and viability of each member institution, including such information that is produced by supervisory authorities, rating agencies, industry analysts or other experts, that has come to the attention of the Corporation, including information about the affiliates of the member institution, assign to the institution a score of

(a) 5 if, as of April 30 of the filing year, no information has come to its attention about circumstances that represent a threat to or compromise the safety, soundness, financial condition or viability of the institution;

(b) 3 if, as of April 30 of the filing year, information has come to its attention about circumstances that represent a threat to the safety, soundness, financial condition or viability of the institution; and

(c) 0 if, as of April 30 of the filing year, information has come to its attention about circumstances that compromise the safety, soundness, financial condition or viability of the institution.

Coming into Force

31 This By-law comes into force on March 31, 1999.

SCHEDULE 1(Sections 3, 4, 7, 8 and 12)

PREMIUM CATEGORIES

| Column 1 | Column 2 | Column 3 | |

|---|---|---|---|

| Item | Premium Category | Total Score | Percentage |

| 1 | 1 | ≥80 | 12.5% |

| 2 | 2 | ≥65 and <80 | 25% |

| 3 | 3 | ≥50 and <65 | 50% |

| 4 | 4 | <50 |

|

SCHEDULE 2(Sections 1, 6, 12, 15, 16 and 20 to 27)

PART 1Interpretation

- 1

(1) The following definitions apply in this Schedule:

- Guidelines

Guidelines means

(a) in the case of a bank, the Guidelines for Banks; and

(b) in the case of any other member institution, the Guidelines for Trust and Loan Companies. (Lignes directrices)

- regulated deposit-taking institution

regulated deposit-taking institution means an entity that is supervised or regulated by a Canadian or foreign financial services or banking regulator and is authorized to accept deposits from the public. (institution de dépôt réglementée)

(2) For the purposes of item 7 of the Reporting Form, the value of assets acquired by a member institution, as a result of a merger or an acquisition described in that item, is the value of the assets on the date of their acquisition as reported in the consolidated financial statements of the member institution.

PART 2Reporting Form

| 1 CAPITAL ADEQUACY MEASURES | |||

| 1.1 Assets to Capital Multiple | |||

| Formula: (Net on- and off-balance sheet assets) ÷ (Total Adjusted Net Tier 1 and Adjusted Tier 2 Capital) | |||

| Complete the following: (1.1.1 — — — —) ÷ (1.1.2 — — — —) = 1.1 | |||

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the Basel II Capital Adequacy Reporting – Credit, Market and Operational Risk (BCAR) form, completed in accordance with Guideline A-1 of the Guidelines as of the end of the fiscal year ending in the year preceding the filing year. | |||

| 1.1.1 Net On- and Off-Balance Sheet Assets Indicate the net on- and off-balance sheet assets as set out for item “O” of Schedule 1 – Ratio and Assets to Capital Multiple Calculations of the BCAR form. | |||

| 1.1.2 Total Adjusted Net Tier 1 and Adjusted Tier 2 Capital for Purposes of ACM Indicate the total adjusted net tier 1 and adjusted tier 2 capital for purposes of ACM as set out for item R of Schedule 1 – Ratio and Assets to Capital Multiple Calculations of the BCAR form. | |||

| 1.1.3 Multiple Authorized by the Regulator For a federal member institution, indicate the assets to capital multiple authorized by the institution’s regulator. For a provincial member institution, indicate the borrowing multiple or non-risk-weighted assets multiple authorized by the institution’s regulator. 1.1.3 | |||

| 1.2 Tier 1 Risk-Based Capital Ratio (%) | |||

| Formula: (Adjusted Net Tier 1 Capital) ÷ (Adjusted Risk-weighted Assets) × 100 | |||

| Complete the following: (1.2.1 — — — —) ÷ (1.2.2 — — — —) × 100 = 1.2 | |||

Elements Use the instructions below to arrive at the elements of the formula. Refer to the Basel II Capital Adequacy Reporting – Credit, Market and Operational Risk (BCAR) form, completed in accordance with Guideline A-1 of the Guidelines as of the end of the fiscal year ending in the year preceding the filing year. | |||

| 1.2.1 Adjusted Net Tier 1 Capital Indicate the adjusted net tier 1 capital as set out for item “A” of Schedule 1 – Ratio and Assets to Capital Multiple Calculations of the BCAR form. | |||

| 1.2.2 Adjusted Risk-Weighted Assets Indicate the adjusted risk-weighted assets as set out for item “D” of Schedule 1 – Ratio and Assets to Capital Multiple Calculations of the BCAR form. | |||

| 1.3 Total Risk-Based Capital Ratio (%) | |||

| Formula: (Total Capital) ÷ (Adjusted Risk-weighted Assets) × 100 | |||

| Complete the following: (1.3.1 — — — —) ÷ (1.3.2 — — — —) × 100 = 1.3 | |||

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the Basel II Capital Adequacy Reporting – Credit, Market and Operational Risk (BCAR) form, completed in accordance with Guideline A-1 of the Guidelines as of the end of the fiscal year ending in the year preceding the filing year. | |||

| 1.3.1 Total Capital Indicate the total capital as set out for item “B” of Schedule 1 – Ratio and Assets to Capital Multiple Calculations of the BCAR form. | |||

| 1.3.2 Adjusted Risk-Weighted Assets Indicate the adjusted risk-weighted assets as determined for element 1.2.2. | |||

| 1.3.3 Required Total Risk-Based Capital Ratio Indicate the total risk-based capital ratio, or other similar ratio using risk-weighted assets, that is required by the member institution’s regulator for that institution. If the regulator does not assign a required ratio, indicate “N/A” (“not applicable”). 1.3.3 | |||

| Score | |||

Use the scoring grid below to determine the member institution’s capital adequacy score. If all the results for the member institution correspond to the range of results set out opposite a score, that score is the score to be assigned to the institution. If the results for the member institution do not all correspond to the range of results set out opposite a score, the lowest of the scores set out opposite each of the results that correspond to the institution’s results is the score to be assigned to the institution. | |||

| Range of Results | |||

| Assets to Capital Multiple | Tier 1 Risk-Based Capital Ratio | Total Risk-Based Capital Ratio | Score |

Assets to capital multiple (1.1) is ≤ the multiple authorized by the regulator (1.1.3) | Tier 1 risk-based capital ratio (1.2) is ≥ 7% | Total risk-based capital ratio (1.3) is: when the member institution does not indicate “N/A” for the required total risk-based capital ratio (1.3.3) and the required ratio is > 8%, ≥ 125% of the required ratio and in all other cases, ≥ 10% | 20 |

Assets to capital multiple (1.1) is ≤ the multiple authorized by the regulator (1.1.3) | Tier 1 risk-based capital ratio (1.2) is ≥ 4% and < 7% | Total risk-based capital ratio (1.3) is: when the member institution does not indicate “N/A” for the required total risk-based capital ratio (1.3.3) and the required ratio is > 8%, ≥ 100% and < 125% of the required ratio and in all other cases, ≥ 8% and < 10% | 13 |

Assets to capital multiple (1.1) is > the multiple authorized by the regulator (1.1.3) | Tier 1 risk-based capital ratio (1.2) is < 4% | Total risk-based capital ratio (1.3) is: when the member institution does not indicate “N/A” for the required total risk-based capital ratio (1.3.3) and the required ratio is > 8%, < 100% of the required ratio and in all other cases, < 8% | 0 |

| 1.4 Capital Adequacy Score | |||

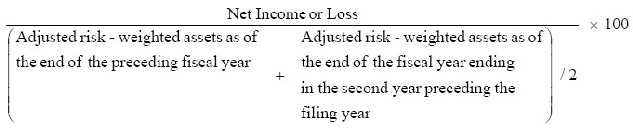

| 2 RETURN ON RISK-WEIGHTED ASSETS (%) | |

Formula: | |

| Complete the following: (2.1 — — — —) ÷ (( 2.2 — — — — + 2.3 — — — — ) / 2) × 100 = 2 | |

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the following documents:

| |

| 2.1 Net Income or Loss The net income or loss (the latter to be reported as a negative number) is the amount set out in item 34 of the Consolidated Statement of Income, Retained Earnings and AOCI. | |

| 2.2 Adjusted Risk-Weighted Assets as of the End of the Preceding Fiscal Year Indicate the adjusted risk-weighted assets as determined for element 1.2.2. | |

| 2.3 Adjusted Risk-Weighted Assets as of the End of the Fiscal Year Ending in the Second Year Preceding the Filing Year Calculate the adjusted risk-weighted assets as of the end of the fiscal year ending in the second year preceding the filing year in the same manner as for element 2.2. If the member institution did not report its adjusted risk-weighted assets using the BCAR form as of the end of the fiscal year ending in the second year preceding the filing year, it must report the same amount as for element 2.2. If the member institution does not have a fiscal year ending in the second year preceding the filing year, it must report “zero”, unless it is an amalgamated institution described below. If the member institution is an amalgamated member institution formed by an amalgamation involving one or more member institutions and does not have a fiscal year ending in the second year preceding the filing year, it must report the same amount as for element 2.2. | |

| Score | |

| Use the scoring grid below to determine the member institution’s score. | |

| Range of results | Score |

| Return on risk-weighted assets (2) is ≥ 1.15 % | 5 |

| Return on risk-weighted assets (2) is ≥ 0.75 % and < 1.15 % | 3 |

| Return on risk-weighted assets (2) is < 0.75 % or a negative number (where 2.1 is a negative number) | 0 |

| 2.4 Return on risk-weighted assets score | |

| 3 MEAN ADJUSTED NET INCOME VOLATILITY | |

If a member institution has been operating as a member institution for less than five fiscal years consisting of at least 12 months each (with the fifth fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 3, 3.1, 3.2 and 3.8 and fill in any of elements 3.3 to 3.7 that apply to it. If a member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than three fiscal years consisting of at least 12 months each (with the third fiscal year ending in the year preceding the filing year), in addition to filling in the applicable elements as an amalgamated member institution, it must also fill in the applicable elements for the amalgamating member institution. If a member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than three fiscal years consisting of at least 12 months each (with the third fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 3, 3.1, 3.2 and 3.8 and fill in any of elements 3.3 to 3.7 that apply to it. | |

| Formula: (Semi-deviation of the net income or loss) ÷ (Mean net income or loss) | |

| Complete the following: (3.1 — — — —) ÷ (3.2 — — — —) = 3 | |

| Elements Use the instructions below to arrive at the elements of the formula. | |

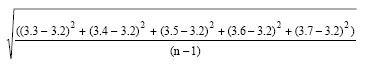

| 3.1 Semi-deviation of the Net Income or Loss Determine the semi-deviation of the net income or loss using the formula  If 3.3 is ≥ 3.2, indicate “0” for (3.3 - 3.2), otherwise calculate as indicated. If 3.4 is ≥ 3.2, indicate “0” for (3.4 - 3.2), otherwise calculate as indicated. If 3.5 is ≥ 3.2, indicate “0” for (3.5 - 3.2), otherwise calculate as indicated. If 3.6 is ≥ 3.2, indicate “0” for (3.6 - 3.2), otherwise calculate as indicated. If 3.7 is ≥ 3.2, indicate “0” for (3.7 - 3.2), otherwise calculate as indicated. | |

| 3.2 Mean Net Income or Loss Determine the mean net income or loss (the latter to be reported as a negative number) using the formula ((3.3 + 3.4 + 3.5 + 3.6 + 3.7)) ÷ n If a member institution has been operating as a member institution for seven or more fiscal years consisting of at least 12 months each, “n” will be equal to 5. If a member institution has been operating as a member institution for six fiscal years consisting of at least 12 months each, “+ 3.7” must be removed from the formula and “n” will be equal to 4. If a member institution has been operating as a member institution for five fiscal years consisting of at least 12 months each, “+ 3.6 + 3.7” must be removed from the formula and “n” will be equal to 3. | |

| Net income or loss (the latter to be reported as a negative number) after tax for each of the last five fiscal years. Indicate the net income or loss as determined for element 2.1 for the fiscal year ending in the year preceding the filing year. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.3. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.4. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.5. Indicate the net income or loss after tax from the audited financial statements for the fiscal year preceding the fiscal year referred to in element 3.6. Indicate the number of fiscal years that the member institution has been operating as a member institution (if less than 7). A member institution must report net income or loss for the last five fiscal years. If a member institution has been operating as a member institution for less than three fiscal years of at least 12 months each and it is a member institution formed by an amalgamation involving only one member institution, it must report the net income or loss of the amalgamating member institution for the three fiscal years or less preceding the amalgamation, as applicable. If a member institution has been operating as a member institution for less than five fiscal years of at least 12 months each, it must report “N/A” (“not applicable”) for the elements corresponding to the fiscal years for which it was not operating as a member institution. | |

| Score | |

| Use the scoring grid below to determine the member institution’s score. | |

| Range of results | Score |

| Mean adjusted net income volatility (3) is ≥ 0 and ≤ 0.4 | 5 |

| Mean adjusted net income volatility (3) is > 0.4 and ≤ 1.0 | 3 |

| Mean adjusted net income volatility (3) is > 1.0 | 0 |

| Mean adjusted net income volatility (3) is negative or the mean net income or loss (3.2) is “zero” | 0 |

| 3.8 Mean adjusted net income volatility score | |

| 4 STRESS-TESTED NET INCOME | |

If a member institution has reported “N/A” (“not applicable”) in element 3.8, it must report “N/A” for elements 4A, 4B and 4.3. | |

| Formulas: (Net income or loss) – (1.4 × Semi — deviation of the net income or loss) = (Stress — tested net income using 1.4 semi — deviations) (Net income or loss) – (2.8 × Semi — deviation of the net income or loss) = (Stress — tested net income using 2.8 semi — deviations) | |

| Complete the following: Stress-tested net income using 1.4 semi-deviations: 4.1 Stress-tested net income using 2.8 semi-deviations: 4.1 | |

| Elements Use the instructions below to arrive at the elements of the formulas. | |

| 4.1 Net Income or Loss Net income or loss as determined for element 2.1. | |

| 4.2 Semi-deviation of the Net Income or Loss The semi-deviation of the net income or loss as determined for element 3.1. | |

| Score | |

| Use the scoring grid below to determine the member institution’s score. | |

| Range of results | Score |

| Stress-tested net income using 2.8 semi-deviations (4B) is ≥ 0 | 5 |

| Stress-tested net income using 1.4 semi-deviations (4A) is ≥ 0, but stress-tested net income using 2.8 semi-deviations (4B) is < 0 | 3 |

| Stress-tested net income using 1.4 semi-deviations (4A) is < 0 | 0 |

| 4.3 Stress-tested net income score | |

| 5 EFFICIENCY RATIO (%) | |

| Formula: (Total non-interest expenses) ÷ (Net interest income + Non-interest income) × 100 | |

| Complete the following: (5.1 — — — —) ÷ (5.2 — — — — + 5.3 — — — — ) × 100 = 5 | |

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the Consolidated Statement of Income, Retained Earnings and AOCI, Reporting Manual, “Income Statement” tab, completed in accordance with that Manual for the fiscal year ending in the year preceding the filing year. | |

| 5.1 Total Non-Interest Expenses Indicate the total non-interest expenses, as set out for item 26 of the Consolidated Statement of Income, Retained Earnings and AOCI, less any charges for impairment included under items 25(l)(i) and (ii) of that Statement. | |

| 5.2 Net Interest Income Determine the net interest income by adding (a) and (b): | |

|  |

|  |

Total (insert as element 5.2 of the formula) |  |

| 5.3 Non-Interest Income Determine the non-interest income by adding (a) and (b): | |

|  |

|  |

Total (insert as element 5.3 of the formula) |  |

| Score | |

Use the scoring grid below to determine the member institution’s score. | |

| Range of results | Score |

| Efficiency ratio (5) is ≥ 0 or ≤ 65% | 5 |

| Efficiency ratio (5) is > 65% and ≤ 85% | 3 |

| Efficiency ratio (5) is > 85% or a negative number | 0 |

| 5.4 Efficiency ratio score | |

| 6 NET IMPAIRED ASSETS (INCLUDING NET UNREALIZED LOSSES ON SECURITIES) TO TOTAL CAPITAL (%) | ||||

| Formula: (Net impaired on-balance sheet assets + Net impaired off-balance sheet assets + Net unrealized losses on securities) ÷ (Total Capital) × 100 | ||||

| Complete the following: (6.1 — — — — + 6.2 — — — — + 6.3 — — — — ) ÷ (6.4 — — — —) × 100 = 6 | ||||

| Elements Use the instructions below to arrive at the elements of the formula. Refer to the following documents:

| ||||

| 6.1 Net Impaired On-Balance Sheet Assets Indicate the net impaired on-balance sheet assets as set out for the total of the column “Carrying Amount” in the Return of Impaired Assets. If the result is negative, report “zero”. | ||||

| 6.2 Net Impaired Off-Balance Sheet Assets Calculate the net impaired off-balance sheet assets by subtracting the total of the column “Specific allowance for impairment” in Table 6A from the total of the column “Credit equivalent” in that Table. If the result is negative, report “zero”. | ||||

| 6.3 Unrealized Losses on Securities Indicate the unrealized losses on investment book securities set out in the column “Total” for item 7 (Unrealized gain/loss on investment book securities) of Section I — Memo Items of the Consolidated Monthly Balance Sheet. If the result is a gain, report “zero”. | ||||

| 6.4 Total Capital Total capital as determined for element 1.3.1. |

Table 6A — Impaired Off-balance Sheet Assets

(Complete Table 6A as of the end of the fiscal year ending in the year preceding the filing year, referring to Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures and Schedule 40 – Derivative Contracts of the BCAR form, to Guideline A-1 of the Guidelines and to the Instructions to OSFI Capital Adequacy Return (effective Q1 2008).)

| Impaired Instruments | Notional principal amount | Credit conversion factor | Credit equivalent | Specific allowance for impairment |

|---|---|---|---|---|

| a | b | (a × b) | ||

| Direct credit substitutes – excluding credit derivatives | 100% | |||

| Transaction-related contingents | 50% | |||

| Short-term self-liquidating trade-related contingents | 20% | |||

| Sale & repurchase agreements | 100% | |||

| Forward asset purchases | 100% | |||

| Forward forward deposits | 100% | |||

| Partly paid shares and securities | 100% | |||

| NIFs & RUFs | 50% | |||

| Undrawn commitments – excluding securitization exposure | 0% | |||

| 20% | ||||

| 50% | ||||

| Impaired OTC Derivative Contracts | ||||

| Credit derivative contracts | Footnote for * | |||

| Interest rate contracts | Footnote for * | |||

| Foreign exchange & gold contracts | Footnote for * | |||

| Equity-linked contracts | Footnote for * | |||

| Precious metals (other than gold) contracts | Footnote for * | |||

| Other commodity contracts | Footnote for * | |||

| Total | ||||

| Use these totals to calculate element 6.2 | ||||

Return to footnote *Fill in the total amounts of the contracts under the heading “Credit equivalent amount” from Table 6B.

Table 6B — Impaired OTC Derivative Contracts

(Complete Table 6B as of the end of the fiscal year ending in the year preceding the filing year, referring to Schedule 39 – Off-balance Sheet Exposures Excluding Derivatives and Securitization Exposures and Schedule 40 – Derivative Contracts of the BCAR form, to Guideline A-1 of the Guidelines and to the Instructions to OSFI Capital Adequacy Return (effective Q1 2008).)

| Impaired OTC Derivative Contracts (in thousands of dollars) | Credit derivative contracts | Interest rate contracts | Foreign exchange & gold contracts | Equity-linked contracts | Precious metals (other than gold) contracts | Other commodity contracts |

| Replacement cost (market value) | ||||||

| a. Contracts held for trading purposes | ||||||

| (all contracts before permissible netting) |

| Gross positive replacement cost | ||||||

| Gross negative replacement cost |

| b. Contracts held for other than trading | ||||||

| (all contracts before permissible netting) |

| Gross positive replacement cost | ||||||

| Gross negative replacement cost |

| c. Contracts subject to permissible netting | ||||||

| (included in a and b above) |

| Gross positive replacement cost | ||||||

| Gross negative replacement cost | ||||||

| Net positive replacement cost |

| d. Total contracts – after permissible netting |

| Gross positive replacement cost |

| Potential credit exposure |

| Contracts not subject to permissible netting | ||||||

| Contracts subject to permissible netting |

| Credit equivalent amount | ||||||

| (after taking into account collateral and guarantees) |

| Contracts not subject to permissible netting | ||||||

| Contracts subject to permissible netting | ||||||

| Total Impaired OTC Derivative Contracts (carry forward to “Credit equivalent” column in Table 6A) |

| Score | |

| Use the scoring grid below to determine the member institution’s score. | |

| Range of results | Score |

| Net impaired assets (including net unrealized losses on securities) to total capital (6) is < 20% | 5 |

| Net impaired assets (including net unrealized losses on securities) to total capital (6) is ≥ 20% and < 40% | 3 |

| Net impaired assets (including net unrealized losses on securities) to total capital (6) is ≥ 40% | 0 |

| 6.5 Net impaired assets (including net unrealized losses on securities) to total capital score |

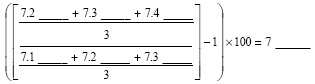

| 7 THREE-YEAR MOVING AVERAGE ASSET GROWTH (%) | |||

If a member institution has been operating as a member institution for less than six fiscal years consisting of at least 12 months each (with the sixth fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for element 7 but still fill in any of elements 7.1 to 7.4 that apply to it. If a member institution formed by an amalgamation involving only one member institution has been operating as a member institution for less than four fiscal years consisting of at least 12 months each (with the fourth fiscal year ending in the year preceding the filing year), in addition to filling in the applicable elements as an amalgamated member institution, it must also fill in the applicable elements for the amalgamating member institution. If a member institution formed by an amalgamation involving two or more member institutions has been operating as a member institution for less than four fiscal years consisting of at least 12 months each (with the fourth fiscal year ending in the year preceding the filing year), it must indicate “N/A” (“not applicable”) for elements 7 and 7.5 but still fill in any of elements 7.1 to 7.4 that apply to it. If a member institution acquires assets in the fiscal year ending in the year preceding the filing year as a result of a merger with or the acquisition of a regulated deposit-taking institution or as a result of the acquisition of the deposit-taking business of a regulated institution, and the value of those acquired assets on the date of their acquisition exceeds 10% of the value of the consolidated assets of the member institution immediately before that merger or acquisition, the member institution must include the value of those acquired assets in elements 7.1 to 7.3. | |||

Formula: | |||

Complete the following: | |||

| Elements Use the instructions below to arrive at the elements of the formula. Refer to Section I of the Consolidated Monthly Balance Sheet, Reporting Manual, “Balance Sheet” tab, completed in accordance with that Manual as of the end of the fiscal year indicated under the heading “Assets for Years 1 to 4” below and

| |||

| Assets for Years 1 to 4 For fiscal years ending in 2007 or earlier, the total of

For fiscal years ending in 2008, the total of

| |||

For fiscal years ending in 2009 or later, the total of

| |||

Year 1: | as of the end of the fiscal year ending in the fourth year preceding the filing year | 7.1 | |

Year 2: | as of the end of the fiscal year ending in the third year preceding the filing year | 7.2 | |

Year 3: | as of the end of the fiscal year ending in the second year preceding the filing year | 7.3 | |

Year 4: | as of the end of the fiscal year ending in the first year preceding the filing year | 7.4 | |

Indicate the number of fiscal years consisting of at least 12 months that the member institution has been operating as a member institution (if less than six).   | |||

A member institution must report assets for the last four fiscal years. If a member institution has been operating as a member institution for less than four fiscal years of at least 12 months each and it is a member institution formed by an amalgamation involving only one member institution, it must report the assets of the amalgamating member institution for the four fiscal years or less preceding the amalgamation, as applicable. If a member institution has been operating as a member institution for less than four fiscal years consisting of at least 12 months each, it must indicate “N/A” (“not applicable”) for the elements corresponding to the fiscal years for which it was not operating as a member institution. | |||

| Score | |||

| Use the scoring grid below to determine the member institution’s score. | |||

| Range of Results | Score | ||

| Three-year moving average asset growth is ≤ 20% (including negative results) | 5 | ||

| Three-year moving average asset growth is > 20% but ≤ 40% | 3 | ||

| Three-year moving average asset growth is > 40% | 0 | ||

7.5 Three-year moving average asset growth score 7.5 Three-year moving average asset growth score | |||

| 8 REAL ESTATE ASSET CONCENTRATION |

| Threshold Formula: (Total Mortgage Loans) ÷ (Total Mortgage Loans + Total Non-Mortgage Loans + Total Securities + Total Acceptances) × 100 |

| Complete the following: (8.1 — — — —) ÷ (8.1 — — — — + 8.2 — — — — + 8.3 — — — — + 8.4 — — — —) × 100 = |

| Elements Use the instructions below to arrive at the elements of the threshold formula. Refer to Section I of the Consolidated Monthly Balance Sheet, Reporting Manual, “Balance Sheet” Tab, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. |

| 8.1 Total Mortgage Loans The total mortgage loans is the total of the amounts set out in the column “Total” for item 3(b) (Mortgages, less allowance for impairment) of Section I of the Consolidated Monthly Balance Sheet, before deducting any allowance for impairment. |

| 8.2 Total Non-Mortgage Loans The total non-mortgage loans is the total of the amounts set out in the column “Total” for items 3(a)(i) to (v), (vii) and (viii) (Non-Mortgage Loans, less allowance for impairment) of Section I of the Consolidated Monthly Balance Sheet. |

| 8.3 Total Securities The total securities is the total of the amounts set out in the column “Total” for item 2(a) (Securities issued or guaranteed by Canada/Canadian Province/Canadian Municipal or School Corporation) and item 2(b) (Other securities, less allowance for impairment) of Section I of the Consolidated Monthly Balance Sheet. |

| 8.4 Total Acceptances The total acceptances is the total of the amounts set out in the column “Total” for item 4 (Customers liability under acceptances, less allowance for impairment) of Section I of the Consolidated Monthly Balance Sheet. |

If the result of the threshold formula is less than 10%, score five for element 8.5 and do not complete the rest of section 8. If that result is greater than or equal to 10%, complete the rest of section 8. |

| Fill in Table 8 using the definitions and instructions below. Refer to Section III of the Mortgage Loans Report, Reporting Manual, “Mortgage Loans” Tab, completed in accordance with that Manual as of the end of the fiscal year ending in the year preceding the filing year. A member institution may complete these calculations using the information reported in the Mortgage Loans Report filed at its year-end or, if not filed at its year-end, at the calendar quarter-end preceding that year-end. |

| Fill in Table 8 for each of the following types of mortgages. |

| Residential Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the instructions in the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for “Total Residential” in the columns “Insured Gross Mortgage Loans Outstanding” and “Uninsured Gross Mortgage Loans Outstanding”, respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Land Banking and Development Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the instructions in the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for item 1(b)(ii)(C) (Land Banking & Development) in the columns “Insured Gross Mortgage Loans Outstanding” and “Uninsured Gross Mortgage Loans Outstanding”, respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Hotel and Motel Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the instructions in the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for item 1(b)(ii)(E) (Hotels/Motels) in the columns “Insured Gross Mortgage Loans Outstanding” and “Uninsured Gross Mortgage Loans Outstanding”, respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Industrial Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for item 1(b)(ii)(D) (Industrial Buildings) in the columns “Insured Gross Mortgage Loans Outstanding” and “Uninsured Gross Mortgage Loans Outstanding”, respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Single Family Dwelling Properties Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for item 1(a)(i) (Single Detached) and item 1(a)(ii)(A) (Condominiums) in the columns “Insured Gross Mortgage Loans Outstanding” and “Uninsured Gross Mortgage Loans Outstanding”, respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Residential Interim Construction Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. Calculate the total mortgage loans of this type by adding together the amounts set out for the element “Of Which Residential Interim Construction Mortgages” in the columns “Insured Gross Mortgage Loans Outstanding” and “Uninsured Gross Mortgage Loans Outstanding”, respectively, in the first table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Second or Subsequent Mortgage Loans Mortgage loans of this type, secured by properties located in Canada, are to be classified in accordance with the Reporting Manual. The total mortgage loans of this type is the amount set out for item 1 (Second and Subsequent Mortgages) in the column “Amounts Outstanding” in the second table of Section III of the Mortgage Loans Report, before deducting any allowance for impairment. |

| Real Estate Under Power of Sale or Foreclosed Properties Properties of this type, located in Canada, are to be classified in accordance with the Reporting Manual. Calculate by adding together

|

Table 8

| A | B | C | D | E |

|---|---|---|---|---|

| Type | Amount | Percentage of Total Mortgage Loans (Amount from Column B ÷ Total Mortgage Loans*) x 100 | Range of Results | ScoreFootnote for Table 8** |

| Residential Properties Mortgage Loans | < 50% = 0 ≥ 50% and < 75% = 3 ≥ 75% = 5 | |||

| Land Banking and Development Mortgage Loans | > 7% = 0 > 5% and ≤ 7% = 3 ≤ 5% = 5 | |||

| Hotel and Motel Properties Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Industrial Properties Mortgage Loans | > 15% = 0 > 10% and ≤ 15% = 3 ≤ 10% = 5 | |||

| Single Family Dwelling Properties Mortgage Loans | < 35% = 0 ≥ 35% and < 50% = 3 ≥ 50% = 5 | |||

| Residential Interim Construction Mortgage Loans | > 8% = 0 > 5% and ≤ 8% = 3 ≤ 5% = 5 | |||

| Second or Subsequent Mortgage Loans | > 10% = 0 > 5% and ≤ 10% = 3 ≤ 5% = 5 | |||

| Real Estate Under Power of Sale or Foreclosed Properties | > 8% = 0 > 5% and ≤ 8% = 3 ≤ 5 % = 5 |

Return to footnote *“Total Mortgage Loans” used in the calculation in column C must correspond to the amount of the Total Mortgage Loans determined for element 8.1.

Return to footnote **Fill in the score in column E for a type of mortgage loan or property set out in column A that corresponds to the percentage set out in column C, in accordance with the appropriate range set out in column D.

| Score | |

| Use the scoring grid below to determine the member institution’s score. | |

| Results | Score |

| Lowest score in Column E of Table 8 is 0 | 0 |

| Lowest score in Column E of Table 8 is 3 | 3 |

| All scores in Column E of Table 8 are 5 | 5 |

| Result of the threshold formula is < 10% of Total Assets | 5 |

| 8.5 Real Estate Asset Concentration Score |

| 9 AGGREGATE COMMERCIAL LOAN CONCENTRATION RATIO (%) |

If the result of the threshold formula in section 8 is greater than 90%, indicate a score of five for element 9.4 and do not complete section 9. If the result of the threshold formula in section 8 is equal to or less than 90%, complete section 9. |

| Formula: (Aggregate Commercial Loan Concentration) ÷ (Total Capital) × 100 |

| Complete the following: (9.1 — — — —) ÷ (9.2 — — — —) × 100 = 9 |

| Elements Refer to Section 6 of the Non-Mortgage Loan Report, Reporting Manual, “Non-Mortgage Loans” Tab. Use the instructions below to arrive at the elements of the formula. A member institution may complete these calculations using the information reported in the Non-Mortgage Loan Report filed at its year-end or, if not filed at its year-end, at the calendar quarter-end preceding that year-end. |

| 9.1 Aggregate Commercial Loan Concentration The aggregate commercial loan concentration is the total of column B in Table 9, expressed in thousands of dollars. |

| 9.2 Total Capital The total capital as determined for element 1.3.1, expressed in thousands of dollars. |

| Fill in Table 9 following the instructions and using the definitions below. |

| Loans Loans are as described in the Non-Mortgage Loan Report |

| Person Means a natural person or an entity. |

| Entity Has the same meaning as in section 2 of the Bank Act. |

| Industry Sectors For the purpose of completing Table 9, commercial loans shall be grouped according to the classifications used for completing the Non-Mortgage Loan Report and using the 12 industry sectors in the list below. |

Industry Sector List

Calculate the commercial loans for each of the industry sectors in accordance with the following list and insert the total on the appropriate line in column A in Table 9. Refer to the Non-Mortgage Loan Report, Reporting Manual, “Non-Mortgage Loans” Tab. |

| Agriculture Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for item 6.(b)(i) (Agriculture) in the Non-Mortgage Loan Report. |

| Fishing & Trapping Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for item 6.(b)(ii) (Fishing & Trapping) in the Non-Mortgage Loan Report. |

| Logging & Forestry Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for item 6.(b)(iii) (Logging & Forestry) in the Non-Mortgage Loan Report. |

| Mining, Quarrying & Oil Wells Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(iv) (Mining, Quarrying & Oil Wells) in the Non-Mortgage Loan Report. |

| Manufacturing Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(v) (Manufacturing) in the Non-Mortgage Loan Report. |

| Construction/Real Estate Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(vi) (Construction/Real Estate) in the Non-Mortgage Loan Report. |

| Transportation, Communication & Other Utilities Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(vii) (Transportation, Communication & Other Utilities) in the Non-Mortgage Loan Report. |

| Wholesale Trade Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(viii) (Wholesale Trade) in the Non-Mortgage Loan Report. |

| Retail Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(ix) (Retail) in the Non-Mortgage Loan Report. |

| Service Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(x) (Service) in the Non-Mortgage Loan Report. |

| Multiproduct Conglomerates Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for Sub-total 6.(b)(xi) (Multiproduct Conglomerates) in the Non-Mortgage Loan Report. |

| Others (Private Not for Profit Institutions, Religious, Health & Educational Institutions) Commercial loans of this type are to be classified in accordance with the Reporting Manual. Calculate the total by adding together the amounts in the columns “Resident, Loan Balances, TC”” and “Non-Resident, Loan Balances, TC” and subtracting the amount in the column “Total, Allowance for Impairment, TC”, all as set out for item 6.(b)(xii) Others (Private Not for Profit Institutions, Religious, Health & Educational Institutions) in the Non-Mortgage Loan Report. |

Table 9

| Instructions | ||